By Alberto Sinesi, Director and Robert Murphy, Senior Managing Director

The Heating, Ventilation and Air Conditioning (HVAC) sector has recorded steady M&A activity year-to-date. This was driven by strategic acquirers – primarily, publicly listed corporations and sponsor-backed entities – expanding their service offering and geographic footprint and private equity investors expanding their industry presence. Overall, the broader HVAC market continues to be bolstered by innovation and technological advancement of HVAC ecosystems, the need to update legacy infrastructure, the acceleration of energy consumption and the increased focus on sustainability. These secular tailwinds have created opportunities for consolidation from strategic and financial acquirers who are eager to unlock synergistic value and generate healthy investment returns.

The industry update herein will primarily focus on the manufacturing and distribution segments of the U.S. HVAC market.

HVAC Sector Overview and Select Key Drivers

- The sector comprises a wide range of participants – manufacturers, distributors and service providers – that deliver generalist and specialist offerings to commercial, residential and industrial end users.

- Performance-wise, the sector has fared well in recent years as a function of large order backlogs and pent-up demand following the pandemic and construction growth globally.

- Looking ahead, growth prospects are anticipated to remain steady; labor shortages, wage inflation and input pricing pressure, however, may have a tapering effect on the sector’s expansion going forward.

Select major industry drivers encompass the following:

- Environmental Regulations – Government regulations, tax benefits and cost savings from upgrading to energy-efficient systems have boosted end user demand for the latest replacement equipment. Further, impending bans on hydrochlorofluorocarbons (HCFCs) are pushing the market toward more advanced HVAC products.

- Eco-Friendly Demand and Innovations – A growing consumer awareness regarding environmental issues is increasing demand for energy-efficient systems, necessitating that market players remain competitive with cost-effective, green solutions. As a result, the HVAC industry is moving toward more eco-friendly practices and materials such as:

- Renewable Energy Integration – Growing use of solar thermal and geothermal heat pumps for heating and cooling with minimal electricity usage

- Low GWP Refrigerants – Transition to eco-friendly refrigerants, replacing high-Global Warming Potential (GWP) refrigerants, thus reducing greenhouse gas impact

- Advanced Environmental Control Technologies – Increasing adoption of variable speed drives and smart controls to precisely manage temperature and humidity

- Heat Recovery Ventilation (HRV) – Focus on maximizing heat transfer, thereby reducing heating and cooling loads

- Zoning and Variable Speed Compressors – Widespread use of zoning and variable speed compressors allowing homeowners to tailor HVAC solutions to their specific home layouts, climate conditions and lifestyle requirements

- Renewable Energy Integration – Growing use of solar thermal and geothermal heat pumps for heating and cooling with minimal electricity usage

- Advancements in Indoor Air Quality (IAQ) – IAQ has taken center stage in the HVAC sector reflecting mounting concerns regarding the health implications of indoor pollution. Solutions to address IAQ issues include advanced filtration (i.e., filters and ultraviolet germicidal lights deactivating airborne viruses, bacteria and mold), bipolar ionization (i.e., treating indoor air by generating charged ions to neutralize harmful particles) and moisture control and ventilation (i.e., moisture control and demand-controlled ventilation enhancing air quality).

- Automation of Industrial Activities – The increasing automation of industrial activities is fostering the need for sophisticated HVAC equipment that manages operating temperatures and lowers the risk of product and system failure.

- Redefining HVAC Services – HVAC as a Service (HVACaaS) is an emerging business model in the sector and is predicated on a subscription-based service stream (as opposed to a series of one-time transactions) whereby end users typically pay for ongoing maintenance, repairs and upgrades.

Observations on M&A Activity

Considerations regarding M&A activity in the HVAC sector command a distinction between manufacturing and distribution segments given the diverse nature of the underlying business models and offerings.

- Manufacturing – Strategic buyers (both public and private) have largely dominated the M&A arena in the manufacturing segment seeking to deploy capital to spur inorganic growth initiatives. Sponsor-backed acquirers have been particularly active in pursuing add-on transactions to generate incremental value to their existing holdings. Overall, valuations have remained robust, especially for those acquisition targets that have a track record of defensible growth and possess a differentiated technology.

- Distribution – M&A activity and valuations in this segment have held steady in more recent periods as supply chain issues affecting HVAC distributors have gradually normalized. Strategic acquirers are expected to continue to battle over additional scale, new product offerings and target markets while the private equity universe continues to eye this fragmented market as the lending environment recovers.

PKF Investment Banking – Recently Closed HVAC M&A Transaction

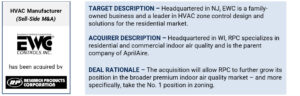

In July 2024, PKF Investment Banking acted as the exclusive financial advisor to EWC Controls Inc. (EWC) in the sale of the business to Research Products Corporation (RPC).

Recent HVAC M&A Mega Deals

Target | Acquirer | Details |

PURMO GROUP (HLSE:PURMO) | APOLLO GLOBAL MANAGEMENT (NYSE:APO) | Private equity investor Apollo and Rettig Group announced the acquisition of Purmo Group. Announcement Date: August 2024 | Deal Size: $658 million (0.9x revenue and 7.4x EBITDA) (April) Rationale: Deal aims to enhance Purmo’s capabilities in sustainable indoor climate solutions and accelerate its growth strategy through additional resources and strategic support. |

JOHNSON CONTROLS (NYSE:JCI) | HITACHI (TSE:6501) A/C (JCH) JOINT VENTURE | ROBERT BOSCH | Robert Bosch announced its acquisition of the global HVAC solutions business for residential and light commercial buildings including the Johnson Controls – Hitachi Air Conditioning joint venture. Announcement Date: July 2024 | Deal Size: $8.0 billion Rationale: Bosch intends to integrate the acquired businesses into its Home Comfort Group. |

COPELAND JOINT VENTURE | BLACKSTONE (NYSE:BX) | Emerson Electric sold its remaining 40 percent interest in the Copeland joint venture to Blackstone Private Equity. Deal Date: June 2024 | Deal Size: $3.5 billion Rationale: Deal aims to capitalize on the growing demand for energy-efficient HVAC solutions driven by stringent regulations and incentives for reducing global energy consumption and greenhouse gas emissions. |

Select Other HVAC M&A Transactions

| Deal Date | Target | Acquirer | Target Description |

| Manufacturing | |||

Jul-24 | Aboveair Technologies | AirX Climate Solutions | Manufacturer of indoor HVAC products intended for commercial and industrial applications. |

May-24 | Check Corporation | Innovative Motion T.(Cathay Capital) | Manufacturer of flexible heating systems intended to serve the automotive, aviation, food services and healthcare industries. |

Mar-24 | Scott Springfield Mfg. | Modine Manufacturing | Manufacturer of custom air handlers. |

Feb-24 | Ingénia Technologies | SPX Technologies (NYSE:SPXC) | Manufactures enhanced quality air handling units intended to serve the technology industry. |

Jan-24 | Air Filter Supply | Rensa Filtration | Manufacturer of heating and air conditioning filters. |

Nov-23 | Industrial Air | Limbach Holdings | Designer and manufacturer of air conditioning and filtration systems intended for industrial applications. |

| Distribution | |||

Apr-24 | R.F. Fager Company | Tenex Capital | Distributor of plumbing, heating, and cooling products intended for commercial and residential projects. |

Jan-24 | Grove Supply | Ferguson | Distributor of plumbing and HVAC products serving residential trade, builder and remodel markets. |

Jan-24 | Plimpton & Hills | Grove Mountain / other financial investors | Supplier of plumbing, heating and cooling products intended for residential and commercial applications. |

Dec-23 | Webb Supply | Beijer Ref | Distributor of HVAC equipment and parts intended to serve contractors across North-East Ohio. |

Source: PitchBook and PKF Investment Banking

Public Company Data as of September 30, 2024

| Company | Market Cap ($M) | Enterprise Value ($M) | LTM Revenue ($M) | LTM EBITDA ($M) | EV / LTM Revenue | EV / LTM EBITDA |

| Manufacturing | ||||||

A. O. Smith | $13,101 | $13,033 | $3,929 | $829 | 3.3x | 15.3x |

AAON | 8,736 | 8,839 | 1,194 | 305 | 7.4x | 29.0x |

Carrier Global | 72,663 | 83,878 | 23,704 | 3,043 | 3.5x | 24.4x |

Daikin Industries | 41,024 | 41,710 | 30,551 | 4,132 | 1.3x | 9.7x |

Global Industrial | 1,298 | 1,347 | 1,346 | 102 | 1.0x | 11.7x |

Honeywell | 134,294 | 154,087 | 37,334 | 9,048 | 4.1x | 16.4x |

Ingersoll Rand | 39,606 | 43,405 | 7,036 | 1,831 | 6.2x | 23.3x |

Johnson Controls | 51,845 | 63,784 | 26,930 | 3,814 | 2.4x | 13.8x |

Lennox International | 21,533 | 23,045 | 5,019 | 999 | 4.6x | 20.6x |

Modine Manufact. | 6,960 | 7,424 | 2,447 | 325 | 3.0x | 21.2x |

SPX Technologies | 7,382 | 8,090 | 1,885 | 368 | 4.3x | 21.1x |

Trane Technologies | 87,725 | 91,687 | 18,830 | 3,527 | 4.9x | 24.5x |

Watsco | 18,513 | 18,933 | 7,434 | 768 | 2.5 x | 20.4 x |

| Distribution | ||||||

Beijer Ref | $8,344 | $9,346 | $3,150 | $340 | 2.8x | 23.0x |

CSW Industrials | 6,092 | 6,271 | 816 | 210 | 7.7x | 28.4x |

Ferguson | 39,861 | 44,807 | 29,635 | 2,987 | 1.5x | 12.6x |

Source: CapIQ

Note: Dollars in U.S. millions; EV = Enterprise Value; LTM = Last Twelve Months

Contact Us

- Alberto Sinesi

Director

PKF Investment Banking

asinesi@pkfib.com | 203.273.5024 - Robert Murphy

Senior Managing Director

PKF Investment Banking

rmurphy@pkfib.com | 561.337.5324

About PKF Investment Banking

PKF O’Connor Davies Capital LLC (DBA PKF Investment Banking) is a subsidiary and investment banking affiliate of PKF O’Connor Davies Advisory LLC. Securities-related transactions are processed through an unaffiliated broker-dealer, Burch & Company, Inc.

Whether a business owner is ready to sell the company or seeking growth through acquisition, our investment banking team is committed and credentialed to help owners achieve their objectives. PKF Investment Banking provides guidance through every step of the process and brings the expertise to enhance certainty to close – while always staying focused on maximizing the value derived from the transaction.

With deep expertise in and a dedicated focus on advising privately held middle-market businesses, the PKF Investment Banking team has completed over 300 M&A and capital raise engagements in North America and abroad during their careers. Our key services include sell-side and buy-side M&A advisory, exit readiness and transaction planning. For more information, visit www.pkfib.com.

PKF Investment Banking provides this report for information purposes only and it does not constitute the provision of financial, legal or tax advice or accounting or professional consulting services of any kind.