By Alan S. Kufeld, CPA, Partner, Edward Poreba, CPA, Senior Manager and James Sutton, CPA, Tax Senior

Families with children who have unearned or investment income (typically, interest and dividends) above a certain amount have long been familiar with the ”kiddie tax.” The kiddie tax rules were enacted in 1986 to prevent parents from shifting income to their children, who were generally in lower income tax brackets.

Beginning January 1, 2018 and through 2025, the kiddie tax rules were overhauled to tax a child’s unearned income — in excess of the threshold amount — at the trust and estate tax rates for ordinary and capital gain income, instead of the income tax rates of the child’s parents.

The kiddie tax applies to investment income of children who:

- are under the age of 18 (regardless of amount of earned income) or, if a full-time student, under the age of 24 (and earned income for the year doesn’t exceed one-half of support);

- have at least one living parent at year-end;

- do not file a joint return; and

- have unearned income that exceeds the $2,100 threshold amount for 2018.

Pre-TCJA (Tax Cuts and Jobs Act) Rules

In 2017, a child was allowed an exemption on the first $1,050 of unearned income. The next $1,050 of unearned income was taxed at the child’s tax rate — likely a fairly low rate, perhaps even at 0% on long- term capital gains. Unearned income in excess of $2,100 was taxed at the parent’s highest income tax rate, which could have been as high as 39.6%. If a parent had multiple children with unearned income, their income was combined to calculate the tax.

New for 2018: Simplification

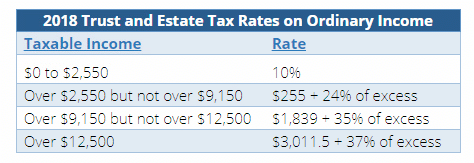

The change simplifies how the tax is calculated as it is no longer impacted by the tax return of the parents or the unearned income of other siblings. Beginning in 2018, the first $2,100 of unearned income is not taxed and amounts over the $2,100 threshold are taxed at the following trust income levels and rates:

Planning

Planning for this tax will revolve around monitoring the level of unearned income as the child would likely pay tax at a higher rate than the parents in certain circumstances, specifically those couples in the mid to lower tax brackets. Those in the highest brackets in 2017 were already near the current top rate of 37% (i.e., the 33% rate applied to income over $233,350, 35% to income over $416,700).

In addition, where an investment in municipal bonds may not have been considered in 2017 when the tax rates were 25%, 28%, or 33%, an increase to the 37% rate may warrant reconsideration. Of course, if the child/student generates earned income (i.e., a summer job) in excess of one-half of support, the kiddie tax will not apply and the more progressive single status rate structure would. Here the 12% tax rate begins at $9,526 and the top 37% rate begins at $500,001. Earned income also creates a Roth IRA funding opportunity where all of the earnings grow tax-free (versus tax-deferred).

Managing the types of assets that are in the names of dependent children will be important. Reinvesting in municipal bonds produces federal tax-free interest income. Certain long-term equity investments can also produce little current income while greatly appreciating over time providing substantial future income, such as securities to be held long-term or unimproved real estate such as land. Utilizing existing tax-advantaged accounts, such as 529 plans and IRAs, can defer tax and avoid paying kiddie taxes now.

Since the TCJA has gone into effect, planning for the kiddie tax changes should be a topic of discussion with your investment and tax advisors. Although the changes to the kiddie tax are simple, they can have a significant impact on your children’s tax liability

Contact Us

If you have questions regarding how these rules will apply to your tax planning, contact any of the individuals listed below or another member of your client service team at PKF O’Connor Davies.

Alan S. Kufeld, CPA

Partner

akufeld@pkfod.com | 646.449.6319

Edward Poreba, CPA

Tax Senior Tax Manager

eporeba@pkfod.com | 646.449.6398

James Sutton, CPA

Tax Senior

jsutton@pkfod.com | 646.965.778