By Thomas J. Riggs, JD, CPA, MAS, Partner and Director Financial Services Tax

The spread of the coronavirus has forced governments across the globe to enact far-reaching stimulus measures in an attempt to blunt the unfolding economic slowdown. The United States has been front and center in this worldwide effort with its recent enactment of the Coronavirus Aid, Relief and Economic Security Act (CARES Act). This Act represents upwards of $2.2 trillion dollars in direct cash based relief that is now immediately available to businesses and individuals.

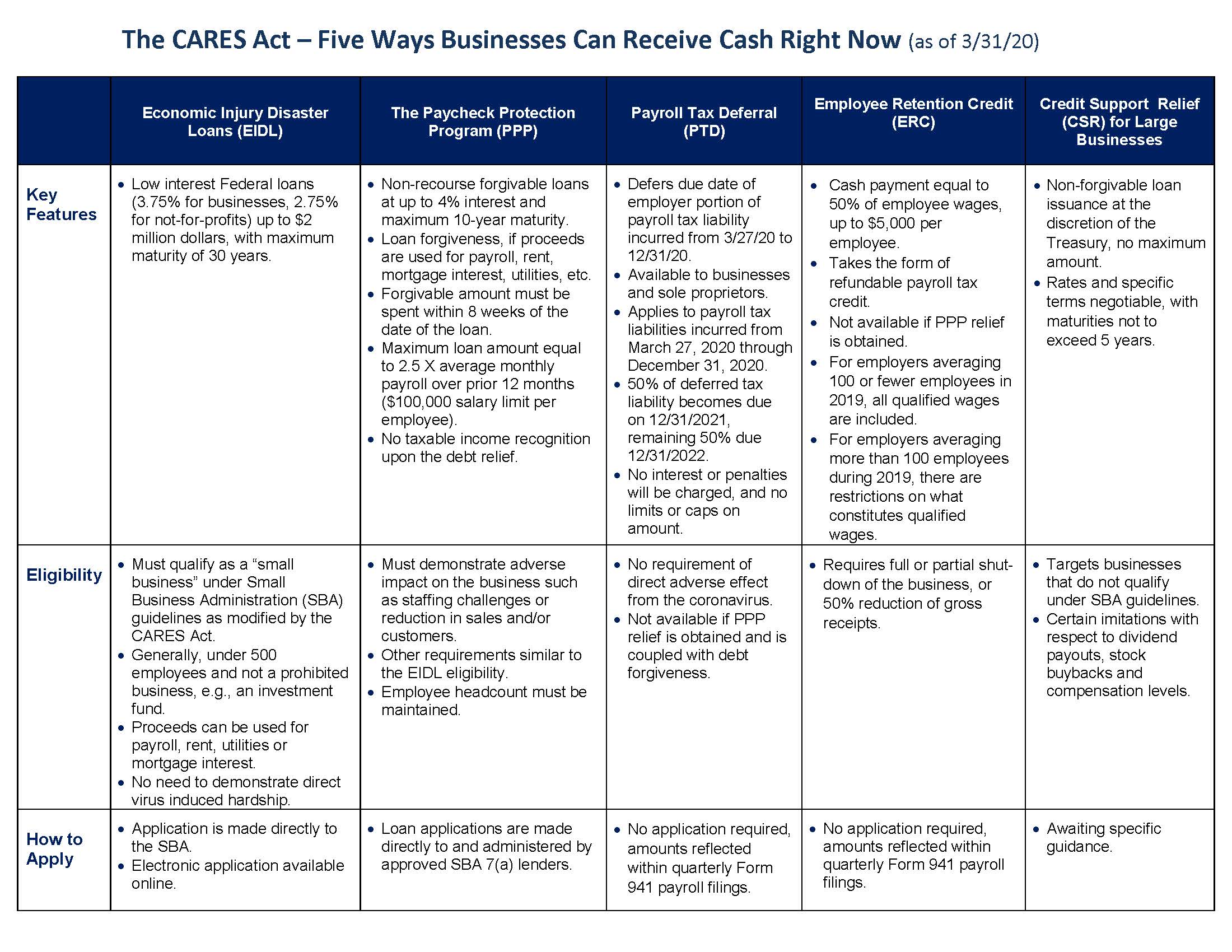

Below, we have outlined the five federal CARES Act programs designed to immediately put cash into the hands of businesses across the country.

About the CARES Act

The CARES Act provides direct cash based relief that is both significant and immediately available to business entities. These federal programs are in addition to any state level relief which is also being made available nationwide. Guidance and even further legislation at the federal level is anticipated, and we will provide updates as these are forthcoming.

Contact Us

The Financial Services Group at PKF O’Connor Davies is available to assist with all aspects of the federal CARES Act stimulus programs. For more information, please visit our COVID-19 Resource Center or contact:

Thomas J. Riggs, JD, CPA, MAS

Partner

Director Financial Services Tax

triggs@pkfod.com | 646.449.6317