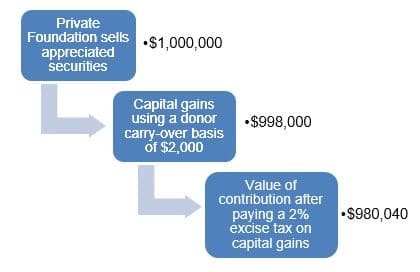

Many private foundations were established using the founder’s securities. These securities may have appreciated in value over the years. The basis of these securities to the private foundation is generally the donor’s basis (i.e., carry-over basis).

Special Situations

There are particular conditions on which basis is determined, including:

- Securities acquired from a decedent receive a “step-up” in basis to its fair market value on the date of the decedent death.

- The basis for determining the gain on securities acquired from a charitable lead annuity trust (CLAT) is the fair market value on the date of donation, since the CLAT already paid tax on the gain.

- Following Internal Revenue Service rules, the basis for determining the gain on sale for property owned prior to December 31, 1969 and held continuously thereafter is the greater of:

- The fair market value of the property on December 31,1969, plus or minus all adjustments after 1969 and before the date of disposition if the property was held by the private foundation on that date and continuously thereafter until disposition, or

- The basis of the property on the date of disposition under normal basis rules (actual basis).

- The fair market value of the property on December 31,1969, plus or minus all adjustments after 1969 and before the date of disposition if the property was held by the private foundation on that date and continuously thereafter until disposition, or

The basis of securities acquired by gift after December 31, 1969 is the donor’s basis at the time of the donation. It is important that a private foundation keep a record of the original cost basis of the donor to ensure the proper tax is paid.

Example

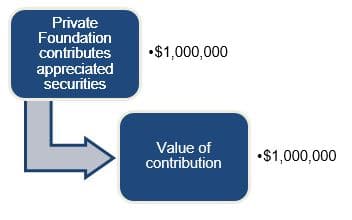

If the private foundation has highly appreciated securities or received donated securities with a very low donor’s cost basis, the private foundation should consider donating the securities to a charitable organization.

Advantages of Donating Securities

When considering making a contribution of securities, the foundation should take into account the following:

- The fair value of the appreciated securities counts towards the calculation of the 5% minimum distribution.

- The payment of excise tax on the gain of the appreciated securities is avoided.

In Conclusion

Donating highly appreciated securities allows the private foundation to maximize its qualifying distributions.

Contact Us

We welcome the opportunity to answer any questions you may have related to this topic or any other accounting, audit, tax or advisory matters relative to private foundations. Please call 212.286.2600 or email any of the Private Foundation Services team members below:

- Thomas F. Blaney, CPA, CFE

Partner, Co-Director of Foundation Services

tblaney@pkfod.com - Joseph Ali, CPA

Partner

jali@pkfod.com - Anan Samara, EA

Principal

asamara@pkfod.com - Christopher D. Petermann, CPA

Partner, Co-Director of Foundation Services

cpetermann@pkfod.com - Scott Brown, CPA

Partner

sbrown@pkfod.com