By Jonathan Zuckerman, CPA, Partner and John M. Haslbauer, CPA, Partner

With the objective of reducing unnecessary burdens on smaller issuers, the Securities and Exchange Commission (SEC) recently adopted amendments to the definition of accelerated and large accelerated filers. As further delineated in this e-newsletter, among other changes, the amended definitions of an accelerated filer and a large accelerated filer will exclude smaller reporting companies (SRC) that have not yet begun to generate significant revenue.

In Brief

The amendments cover the following:

- Exclude from the accelerated and large accelerated filer definitions an issuer that is eligible to be a SRC and had no revenues or annual revenues of less than $100 million in the most recent fiscal year for which audited financial statements are available.

- Increase the transition thresholds for exiting accelerated and large accelerated filer status from $50 million to $60 million (accelerated to non-accelerated) and $500 million to $560 million (large accelerated to accelerated).

- Add a revenue test to the transition thresholds for exiting both accelerated and large accelerated filer status.

- Add a check box to the cover page of annual reports on Form 10-K, 20-F and 40-F to indicate whether the ICFR (internal control over financial reporting) auditor attestation is included in the filing.

Effect on Certain Issuers

The impact for issuers that become non-accelerated filers as well as for SRCs with less than $100 million in revenues will result in extended filing deadlines, and they no longer will be required to obtain an annual attestation on ICFR from their independent registered public accounting firm.

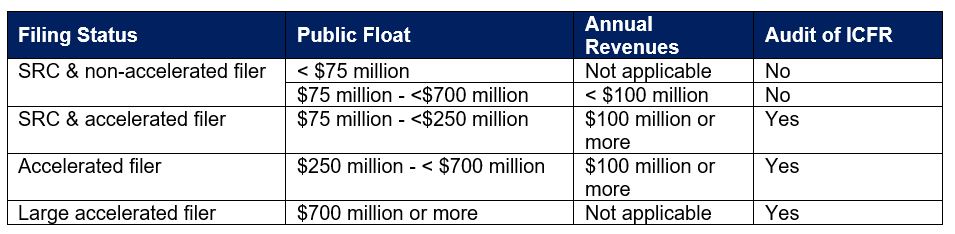

A summary of the amendments to filing requirements are as follows:

More Information

For a complete version of the rule, click here. The amendments will become effective 30 days after their publication in the Federal Register. The final amendments will apply to annual report filings due on or after the effective date.

Contact Us

If you have any questions about these new rules applicable to SEC-regulated companies – or any other accounting and auditing matters – please contact either of the following partners or the partner in charge of your account:

Jonathan Zuckerman, CPA

Partner

jzuckerman@pkfod.com

John M. Haslbauer, CPA

Partner

jhaslbauer@pkfod.com