By Jonathan Zuckerman, CPA, John M. Haslbauer, CPA and Ioanna Vavasis, CPA

The Securities and Exchange Commission (SEC) recently issued proposed amendments to modernize and eliminate certain duplicative registrant disclosures in Regulation S-K. The proposed amendments generally relate to the Management’s Discussion and Analysis (MD&A) section. The objective of these proposed amendments is to benefit investors and simplify compliance for issuers.

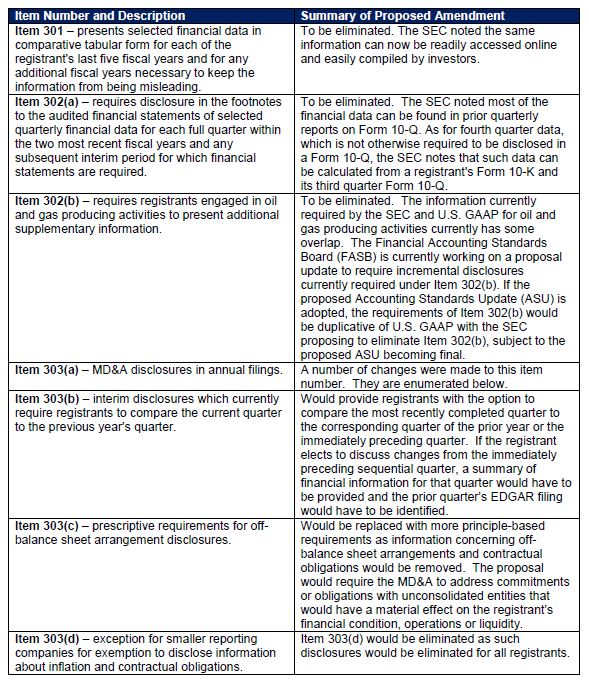

The proposed amendments would:

- eliminate Item 301 of Regulation S-K, Selected Financial Data, and Item 302 of Regulation S-K, Supplementary Financial Information (as the required information is largely duplicative of other existing requirements in Regulation S-K), and

- amend Item 303 of Regulation S-K, MD&A, to streamline the required disclosures and focus on material information.

Summary of Proposed Amendments

Item 303(a) – MD&A Disclosures in Annual Filings

A number of changes were made to Item 303(a), some of which are:

- To clarify and emphasize the objectives of the MD&A for full years and interim periods. The SEC’s objective is that the proposed changes would enable investors to see a registrant through the eyes of management.

- To add product lines as an example of other subdivisions of a registrant’s business that should be discussed when, in the registrant’s judgment, such a discussion would be necessary to an understanding of the company’s business.

- As part of the discussion on capital resources, a description as of the latest fiscal period of the registrant’s material cash requirements, including: (1) the anticipated source of funds needed to satisfy such cash requirements, and (2) the general purpose of such requirements.

- A description of the causes of material changes from year-to-year in financial statement line items when it is necessary to an understanding of the registrant’s business as a whole.

- To require disclosure of events that are reasonably likely to cause a material change in the relationship between costs and revenues.

- To eliminate the requirement to discuss the effect of inflation and changing prices. Note, however, that registrants would still be expected to discuss the impact of inflation or changing prices if they are part of a known trend or uncertainty that has had, or is reasonably expected to have, a material favorable or unfavorable impact on net sales, revenue, or income from continuing operations.

- To modify the requirement to disclose off-balance sheet arrangements by eliminating the definition of such arrangements and requiring a discussion of commitments or obligations, including contingent obligations, arising from arrangements with unconsolidated entities that have, or are reasonably likely to have, a material current or future effect on a registrant’s financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, cash requirements, or capital resources.

- To eliminate the requirement to present a table of contractual obligations because much of the required information overlaps with U.S. GAAP.

- To codify the SEC’s interpretive guidance to disclose critical accounting estimates. The proposal would require registrants to disclose why the estimate is subject to uncertainty, how much each estimate has changed in the reporting period and the sensitivity of the reported amounts to fluctuations in the material methods assumptions and estimates underlying the calculation.

Other Considerations

The proposed amendments would also provide a consistent approach to MD&A for domestic registrants and foreign private issuers who file Form 20-F. As for Canadian foreign private issuers that are eligible to use Canadian disclosure documents to satisfy the SEC’s registration and disclosure requirements, Form 40-F would be amended to eliminate the requirement to present a table of contractual obligations and to make corresponding changes to the off-balance sheet disclosure requirements.

Additional conforming amendments would be made to disclosures of:

- Pro Forma Financial Statements and Selected Financial Data,

- Significant Obligors of Pool Assets,

- Credit Enhancement and Other Support

- Certain Derivatives Instruments,

- Forms S-1 and F-1 under conditions providing for the use of a summary prospectus pursuant to Securities Act Rule 431, and

- Form S-4, Form F-4 and Schedule 14A in respect of business combinations.

The proposal is subject to a 60-day comment period following its publication in the Federal Register.

For a complete version of the rule proposal, click here.

Contact Us

If you have any questions about these new proposed rules applicable to SEC-regulated companies – or any other accounting and auditing matters – please contact any of the following or the partner in charge of your account:

Jonathan Zuckerman, CPA

Partner

jzuckerman@pkfod.com

John M. Haslbauer, CPA

Partner

jhaslbauer@pkfod.com

Ioanna Vavasis, CPA

Senior Manager

ivavasis@pkfod.com