By Darren Bushey, CPA, Partner; Justin Warren, CPA, Director; and Kamila Magiera, EA, Senior Associate

As natural disasters have increased in both frequency and intensity, those in their paths are left to deal with the profound devastation. The recent wildfires in Southern California and Hurricanes Helene and Milton, among 18 named storms in Florida, have caused significant destruction. While the devastation brought by these natural disasters is far-reaching, being aware of the U.S. tax laws designed to help victims get back on their feet can offer some relief. We unpack the laws/regulations you should know, with important provisions, timelines and examples.

IRC 165(h): Treatment of Casualty Gains and Losses

Under Internal Revenue Code (IRC) 165(h), individual losses from each casualty or theft are deductible only if they exceed $100 for taxable years beginning after December 31, 2009, with losses of personal-use property deductible only if the loss is attributable to a federally declared disaster.

If personal casualty losses exceed personal casualty gains in a taxable year, the losses are deductible only to the extent that they exceed the amount of personal casualty gains. If gains exceed losses, all gains/losses are treated as gains/losses from the sale or exchange of capital assets.

Regs. Sec. 1.165-7(b): Amount of Casualty Loss

Regulations Section (Regs. Sec.) 1.165-7(b) provides that the amount of a personal, business or investment casualty loss is the lesser of:

- The fair market value (FMV) of the property immediately before the casualty, minus the FMV immediately after the casualty (reduced by insurance proceeds) or

- The adjusted basis for determining the loss on the sale or disposition of that property (reduced by insurance proceeds).

165(h) Provisions

While casualty losses originally had to exceed 10% of an individual’s adjusted gross income to be deductible, recent legislation signed into law on December 12, 2024 waived this requirement. Instead, each casualty loss is now deductible once it surpasses a $500 threshold.

Other provisions for personal casualty losses related to qualified disasters were included in the December 2024 legislation:

- Additional Standard Deduction: Taxpayers can also claim these losses as an itemized deduction in addition to the standard deduction using Schedule A as follows:

- List the amount from Form 4684, line 15, on the dotted line next to line 16 as “Net Qualified Disaster Loss,” and attach Form 4684.

- List your standard deduction amount on the dotted line next to line 16 as “Standard Deduction Claimed With Qualified Disaster Loss.”

- Combine the two amounts on line 16 and enter on Form 1040 or 1040-SR, line 12.

- Note: This favorable treatment applies to all presidentially declared disasters (listed on the FEMA website) occurring between January 1, 2020, and January 11, 2025 (if declared by February 9, 2025).

- Losses from Wildfires: Taxpayers can exclude from gross income any compensation received as qualified wildfire relief payments. These payments include compensation for losses, damages, additional living expenses, lost wages (excluding employer-paid wages), personal injury, emotional distress or death. To qualify, the losses must result from a federally-declared wildfire disaster and cannot have been compensated by insurance or other means. For example, the recently announced FEMA checks of $770 to victims of the California wildfires will not be taxable.

- This provision applies to payments received during taxable years beginning after December 31, 2019, and before January 1, 2026. Taxpayers should note that no deduction or credit is permitted for expenses covered by excluded payments. Similarly, if these payments are used to acquire or improve property, they cannot increase the property’s tax basis.

- For claims related to wildfire relief payments, the statute of limitations for filing a refund or credit claim will not expire earlier than one year after the enactment date of this law. Normal limitations on refund amounts under section 6511(b)(2) do not apply in these cases. This ensures taxpayers have ample time to seek relief for qualified wildfire payments.

Sec. 111, Rev. Rul. 71-160: Filing Timelines

At the election of the taxpayer, losses attributable to a federally declared disaster may be taken into account for the taxable year immediately preceding the taxable year in which the disaster occurred. For example, the Eaton fires in Los Angeles County occurred in 2025, but the losses attributable to those fires may be reflected on the taxpayers 2024 return. Under Section (Sec.) 111, Revenue Ruling (Rev. Rul.) 71-160, if the taxpayer receives an insurance reimbursement for the loss in a later year, the reimbursement is included in income of the year received.

Note: Certain deadlines falling on or after January 7, 2025, and before October 15, 2025, are granted additional time to file. As a result, affected individuals and businesses will have until October 15, 2025, to file returns and pay any taxes that were originally due during this period. Reference this recent IRS Announcement for complete information.

Consider this Example

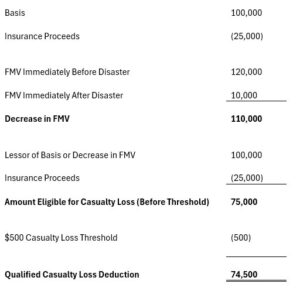

A federally declared disaster occurs and property with an adjusted basis of $100,000 is destroyed. Insurance proceeds of $25,000 related to the destroyed property were received by the taxpayer. The fair market value of the property was $120,000 immediately before the disaster and $10,000 immediately after. As a result, the taxpayer may take a $74,500 deduction on their Schedule A related to the casualty loss:

Contact Us

PKF O’Connor Davies professionals understand the tax laws that can provide relief to individuals and businesses impacted by natural disasters. We are here to help. If you have any questions regarding personal casualty or have any other tax issues, please reach out to your designated PKF O’Connor Davies tax advisor or any of the following tax specialists:

Darren Bushey, CPA

Partner

dbushey@pkfod.com

Justin Warren, CPA

Director

jwarren@pkfod.com

Kamila Magiera, EA

Senior Associate

kmagiera@pkfod.com