By Robert Murphy, Senior Managing Director

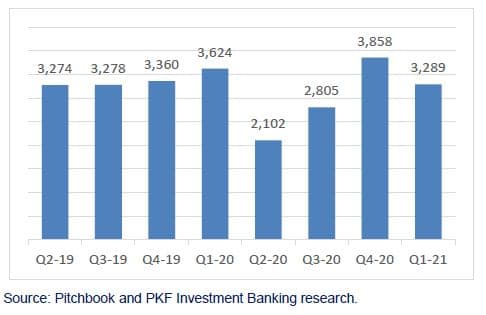

North American M&A deal activity remained robust in Q1 of 2021 following a record-breaking Q4 in 2020. However, year-over-year deal volume was 9.3% lower than Q1 2020.

Closed M&A Deals in North America (Q2 2019 – Q1 2020)

The vaccine rollout is helping to reduce uncertainty for buyers and sellers and CEO confidence levels, as measured by The Conference Board, are at all-time highs. This, along with low interest rates, active credit markets and significant levels of available capital looking for a home, is driving a heated M&A market. Dry powder with U.S. equity firms at the end of 2020 was $1.5 trillion, an increase for the sixth year in a row, and non-financial corporations held $1.7 trillion in cash at the end of 2020, a significant increase from 2019.

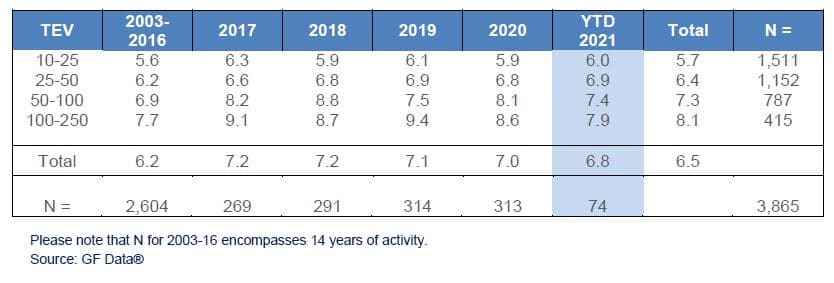

Transaction Multiples Remained Strong

Average transaction multiples in Q1 2021 with Total Enterprise Values (TEV) of $10 million to $250 million decreased slightly, with an average of 6.8x EBITDA. This departs from the widely held view that valuations have risen, not fallen, over the past nine months. It is clearly a robust seller’s market, especially for those companies that have performed well through COVID. The 6.8x average does not give the true picture, as strong performing companies are trading at multiples above pre-pandemic levels. The average is being brought down by: companies negatively impacted by COVID trading at lower multiples, higher percentage of add-ons which typically trade a bit below platform acquisitions, and an increased number of deals with earn-outs as the earn-out value is excluded from TEV in the following chart.

Total Enterprise Value (TEV)/EBITDA

Higher performers with above-average trailing twelve month (TTM) EBITDA margins and sales growth are rewarded with premium valuation multiples. In Q1 2021, the buyout targets with above average financial performance were valued at an average of 7.6x, which represents 34% premium, compared to a historic average of 14% while the rest of the buyout targets in Q1 were valued at an average of 5.7x. In this marketplace, there is a stark contrast between the targets that have strong TTM performance with clear industry sector visibility and companies with weak TTM performance and cloudy visibility.

Quality Premium – Buyouts Only

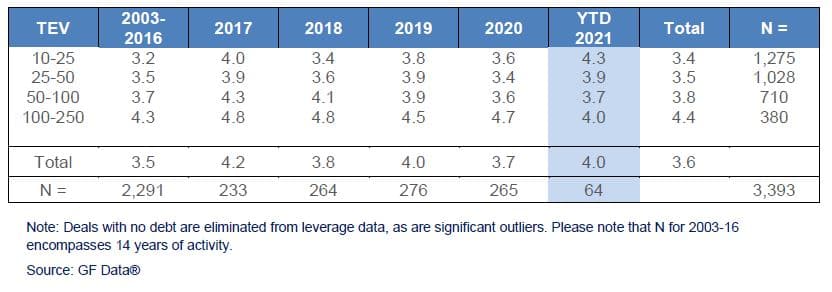

Debt Leverage Reverted to Pre-COVID Levels in Q1 2021

Debt utilization returned to pre-COVID levels in Q1 2021, reflecting a reversion to more normal capital structures as lending institutions regained confidence.

The average debt leverage in Q1 2020 of 4.0x EBITDA comprised 3.7x senior debt and 0.3x subordinated debt, compared with 3.1x and 0.6x in 2020, respectively. The increased share of add-ons attributes to the higher percentage of senior debt as most of the add-ons tend to complete these transactions with a debt structure comprised of all senior debt.

There has been an increase in the use of earn-outs to address financial performance concerns and lack of industry visibility for companies that have not returned to pre-COVID levels.

Total Debt/EBITDA – All Industries by Deal Size

Outlook for Remainder of 2021

Several tailwinds should continue to support robust activity for the remainder of 2021. Deal activity in Q2 and Q3 should be significantly above 2020 levels with strong valuation multiples.

- Business conditions in COVID-impacted sectors improving as vaccination increases.

- Improving economy and government stimulus.

- Low interest rates and supportive debt market for transactions.

- Renewed confidence among corporate buyers to deploy capital and seek growth through acquisitions.

- Record levels of capital with financial and strategic buyers seeking targets.

An infrastructure spending plan, if approved, should help to drive transaction activity and a capital gains tax rate increase for 2022, if approved, could create a frenzied M&A market to finish out the 2021 year.

Contact Us

Robert Murphy

Senior Managing Director

rmurphy@pkfod.com

561.337.5324 | 201.788.6844