By Bruce L. Blasnik, CPA, CGMA, Partner

Now that many businesses have received Paycheck Protection Program (PPP) forgivable loans, and many more have submitted their applications and remain hopeful, the focus has shifted from eligibility and application submission to loan forgiveness. Like many other aspects of the PPP, the rules for determining forgiveness are complicated and confusing. In this article, we will walk you through the four-step process for calculating loan forgiveness.

It should be understood that this guidance may change. And given that the rules regarding eligibility for a PPP loan and for determining the amount of the loan changed nearly daily for the better part of a month, there’s a very good chance it will change. The guidance below is based on information available as of April 27, 2020 and our interpretation of that guidance. As updated guidance becomes available, we will keep you apprised.

Now for the four steps.

Step 1 – Determine Your Eligible Costs

According to the CARES Act the following costs incurred and payments made during the 8-week period beginning with the date you receive the first advance of PPP loan funds (the “forgiveness period”) are eligible for forgiveness:

- Payroll Costs. These are the same costs you used to determine the amount of your loan. They include:

- Salaries, wages, commissions, tips, vacation, parental, family medical or sick leave and other cash compensation, not to exceed an annualized rate of $100,000 for any employee;

- Payment required for group health benefits (the employer’s contribution);

- Payment of any retirement benefits (the employer’s portion);

- Payments [by the employer] of state or local tax assessed on employee compensation (most typically, state unemployment insurance); and

- For a self-employed person, including partners in a partnership and members of a limited liability company, the first $100,000 of annualized self-employment income (as reported on Schedules SE or K-1) prorated for the forgiveness period. (We recommend that you actually take these draws, totaling at $15,385, during the forgiveness period.)

- Mortgage Interest. Any payment of interest on a covered mortgage obligation. A covered mortgage obligation is a mortgage on real or personal property that was incurred before February 15, 2020. Payments of principal are excluded from eligible costs.

- Rent. Any payment of a covered rent obligation. A covered rent obligation is rent obligated under a leasing arrangement in force before February 15, 2020. We believe this includes leases on both real and personal property.

- Utilities. Any covered utility payment. This includes payments for the distribution of electricity, gas, water, transportation, telephone or internet access for which service began before February 15, 2020.

Cash or accrual basis?

It is unclear what the Act intended. Absent further guidance, we recommend that you count compensation costs on both an incurred and paid basis. In other words, for the first payroll in the forgiveness period, include only the days that fall within the forgiveness period. Then, to be safe, split the last payroll in the forgiveness period into two payrolls, one that runs through and is paid by the last day of the forgiveness period, and a second to cover the balance of the payroll period.

With regard to other eligible costs, including health benefits, mortgage interest, rent and utilities, make the payments as they become due under the terms of the underlying agreements, making sure to make at least two monthly payments for each type of cost within the 8-week forgiveness period.

What about CAM charges or real estate tax escalations?

Again, it is unclear. To the extent common area maintenance and real estate taxes are embedded in your rent payments, there should be no question that these are eligible costs. But for separately stated escalations and pass-through charges on net leases, there is no clear answer. If you owned the real estate, the real estate taxes and certain maintenance costs would not be eligible for forgiveness. So perhaps, this is the most prudent route to take. On the other hand, if you do not own the property, these embedded costs are eligible for renters. This is probably not an unreasonable position. Unless or until further guidance becomes available, we can’t give you any more definitive advice on this issue.

Step 2 – Determine Your FTEs

You will need to calculate your average full-time equivalent employees (FTEs) for three separate periods:

- The 8-week forgiveness period;

- The period February 15, 2019 to June 30, 2019; and

- The period January 1, 2020 to February 29, 2020.

To calculate the average, you determine the number of FTEs for each payroll period within the applicable period and then take the average. To determine the number of FTEs in a payroll period, start with the number of full-time employees. For this purpose, any employee who is paid for more than a certain number minimum number of hours should be considered full-time. For example, the Affordable Care Act (ACA) uses a threshold of 30 hours a week to define full-time employees. We suggest you use either the ACA threshold or your standard work day/week as the threshold. Add to this a) the total hours worked by all part-time employees, divided by b) the standard number of hours in the pay period.

For purposes of determining FTEs in the forgiveness period, employees do not actually have to be working in order to be counted. They just need to be paid as if they are working. Full-time employees should be paid as full-time employees. Part-time employees should be paid as if they were working the hours they typically work.

Bonus. If you have employees that were laid-off or furloughed between February 15, 2020 and April 26, 2020 (and they are not being paid) you can include these employees in your FTE calculation as if they were there for the entire forgiveness period as long as they are re-hired or replaced by June 30, 2020. We are awaiting guidance on what it means to re-hire or replace employees by June 30th, but it is very unlikely they’ll qualify if you lay them off again on July 2nd.

Step 3 – Determine Your Excess Wage Reductions

Now this gets a bit complicated. First, understand that this computation only applies to an employee who earned less than $100,000 on an annual basis, prorated for the period, in the most recent full calendar quarter that they were employed prior to the forgiveness period (the “base period wages”). Second, it only applies if you reduced an employee’s salary by more than 25%. So if you didn’t reduce the salary of anyone who earned less than $100,000 by more than 25%, you can disregard this step. Consider yourself lucky. You can also disregard this step if the wage reductions initially occurred between February 15, 2020 and April 26, 2020 and the employee’s wages are/were returned to the base period wages not later than June 30, 2020.

If you have any employees to which this step applies, for each such employee you take the difference between a) 75% of their previous annualized salary and b) their actual reduced annualized salary. You then take this amount, divide by 52 and multiply by 8. You add up these amounts for all applicable employees. This is your excess wage reduction amount.

Step 4 – Calculate Your Forgiveness Amount

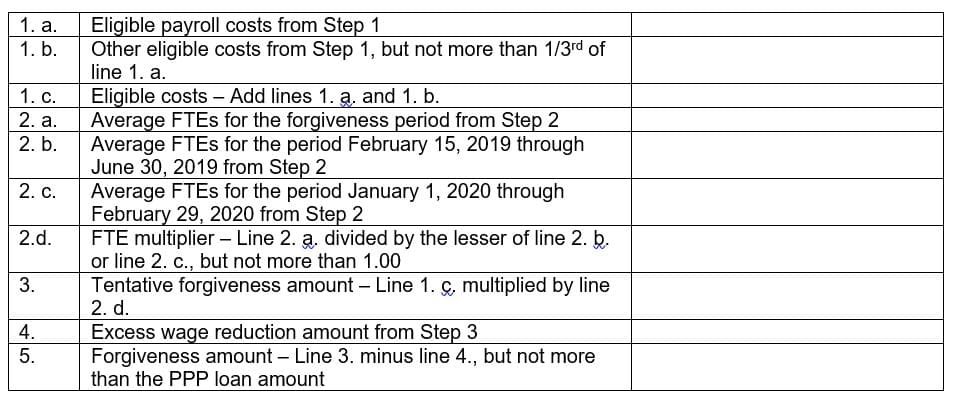

Now, to determine the amount of forgiveness you qualify for, complete the table below.

Planning Ideas

Given the lack of clarity in the Act, there are many planning opportunities being bandied about. Ideas like paying bonuses, running an extra payroll in order to get nine weeks of pay into the 8-week forgiveness period, or paying your full 2019 or 2020 profit sharing contribution in the forgiveness period. We want to make sure you are aware of these potential opportunities. But we believe that many of these ideas may not hold up to scrutiny. The Act allows forgiveness for costs incurred and payments made in the forgiveness period. It is difficult to imagine that accruing extra payroll costs or making a full year’s profit sharing contribution meets this standard. We will keep you advised and make sure that you are aware of any reasonable planning opportunities that arise.

Contact Us

As always, for further guidance and assistance, please reach out to your PKFOD engagement team members or Bruce L. Blasnik, CPA, CGMA, Partner at CLT-SBATechnical@pkfod.com. We are here to help.