By Jonathan Zuckerman, CPA, Partner, Kathleen Mills, CPA, Senior Manager, and Samuel Botta, CPA, Senior Manager

In response to feedback received from various stakeholders, the Financial Accounting Standards Board (FASB or Board) voted on May 20, 2020 in favor of a one-year deferment of the implementation of the Revenue Recognition (ASC 606) and Leases (ASC 842) standards for private companies that have yet to issue their financial statements. This is a result of the continuing struggle private companies are facing carrying out daily accounting tasks in light of the COVID-19 pandemic.

In March 2020, the Board also issued Accounting Standards Update (ASU) 2020-04, Reference Rate Reform (ASC 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The accounting guidance provided in this ASU follows.

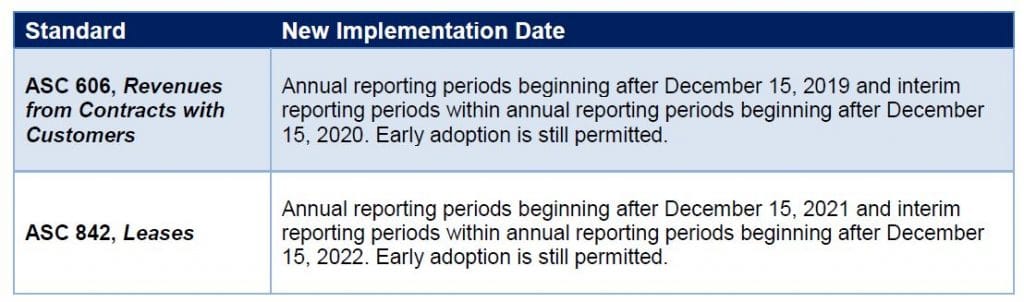

Implementation Dates: ASU on Revenue Recognition and Leases

The following summarizes the new effective implementation dates of these accounting standards for Revenue Recognition (ASC 606) and Leases (ASC 842).

The FASB intends to issue the final amendment within the next month.

ASU 2020-04: Reference Rate Reform

On March 12, 2020, the FASB issued Accounting Standards Update (ASU) 2020-04, Reference Rate Reform (ASC 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting. It is expected by the end of 2021, banks will no longer be required to report the London Interbank Offered Rate (LIBOR). LIBOR is one of the most commonly used benchmark interest rates for derivative and other commercial agreements.

As LIBOR phases out, banks and regulators are expected to use alternative reference rates, such as the Secured Overnight Financing Rate (SOFR). While LIBOR is developed by using a panel of banks which submit estimates of their borrowing costs, SOFR is calculated using actual transactions and is considered a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

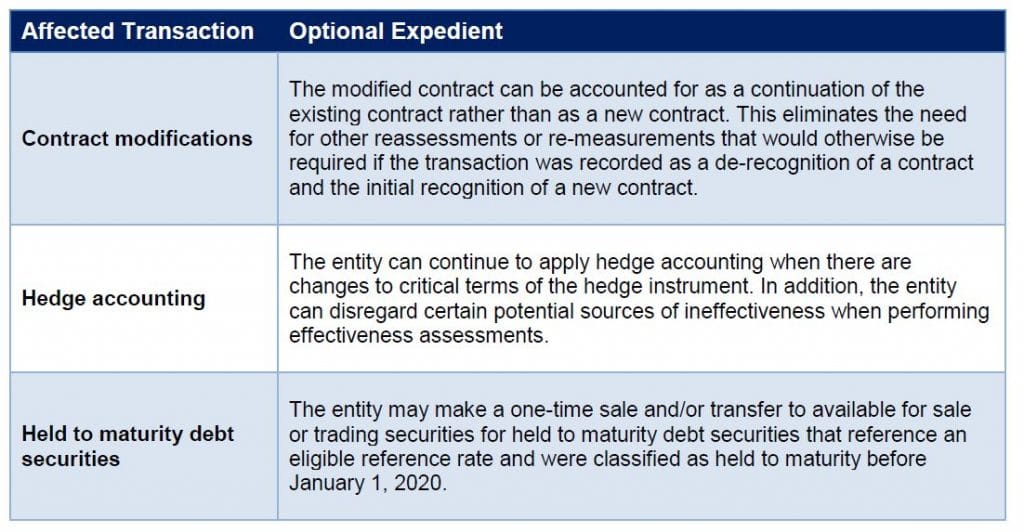

The ASU applies to all entities and provides optional guidance to simplify the potential accounting challenges associated with the reference rate reform.

The ASU was effective as of March 12, 2020 and remains in effect until December 31, 2022. The ASU can be applied as of the beginning of the interim period that includes March 12, 2020 (January 1, 2020 for calendar year-end companies) or any date thereafter.

Contact Us

If you require assistance understanding any of these accounting updates, please contact the partner in charge of your account or:

Jonathan Zuckerman, CPA

Partner

JZuckerman@pkfod.com

Kathleen Mills, CPA

Senior Manager

KMills@pkfod.com

Samuel Botta, CPA

Senior Manager

SBotta@pkfod.com