On April 9, 2020, the Department of Treasury and the Internal Revenue Service issued Notice 2020-23 updating Notice 2020-18-Relief for Taxpayers Affected by Ongoing Coronavirus Disease 2019 Pandemic which automatically postponed filing federal income tax returns and making federal income tax payments to July 15, 2020.

Notice 2020-23 specifically includes the automatic extension of the following:

- Return filings of Form 990-PF, Return of Private Foundation or Section 4947 (a)(1) Trust Treated as a Private Foundation, to July 15, 2020;

- Form 990-T, Exempt Organization Business Income Tax Return;

- Excise tax payments on investment income; and

- Tax payments on unrelated taxable income.

Any foundation that had an estimated tax payment due on or after April 1, 2020, and before July 15, 2020, can wait until July 15 to make that payment without penalty. The payments due on July 15 include the following:

- Tax due with extension,

- 1st quarter estimated payment, and

- 2nd quarter estimated payment.

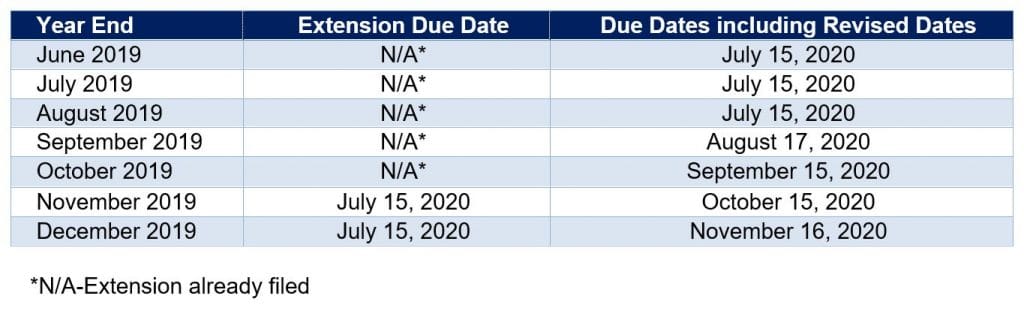

This relief is automatic; however, foundations that need additional time to file may choose to file the appropriate extension by July 15, 2020. Below is a chart detailing the various fiscal year-end due dates:

Contact Us

We welcome the opportunity to answer any questions you may have related to this topic or any other accounting, audit, tax or advisory matters relative to private foundations. Please call 212.286.2600 or email any of the Private Foundation Services team members below:

- Thomas F. Blaney, CPA, CFE

Partner, Co-Director of Foundation Services

tblaney@pkfod.com - Joseph Ali, CPA

Partner

jali@pkfod.com

Anan Samara, EA

Raymond Jones, Sr., CPA

Partner

rjones@pkfod.com

Principal

asamara@pkfod.com - Christopher D. Petermann, CPA

Partner, Co-Director of Foundation Services

cpetermann@pkfod.com - Scott Brown, CPA

Partner

sbrown@pkfod.com

Barbara Van Bergen, CPA

Partner

bvanbergen@pkfod.com