By Gabriel G. Lengua, CPA, Partner

Direct-to-consumer (DTC) brands have flourished in recent years. Many companies, including both well-established and insurgent brands, are choosing to bypass intermediary channels and take their product directly to the customer. It’s not hard to understand why. Yes, there is a profit motive but by bypassing retailers, DTC brands are better able to foster long-term relationships directly with their customer. They gain control over the transaction, user experience and customer information, which are critical in generating repeat purchases and customer loyalty.

Customers are constantly seeking simplicity, efficiency and personalization in nearly every aspect of their lives. DTC companies satisfy all of these things. By virtue of the digital platforms they use, DTC companies are able to collect valuable customer data and further personalize the experience. They also use the DTC model to relate to the customer with authenticity and transparency and this helps them build trust.

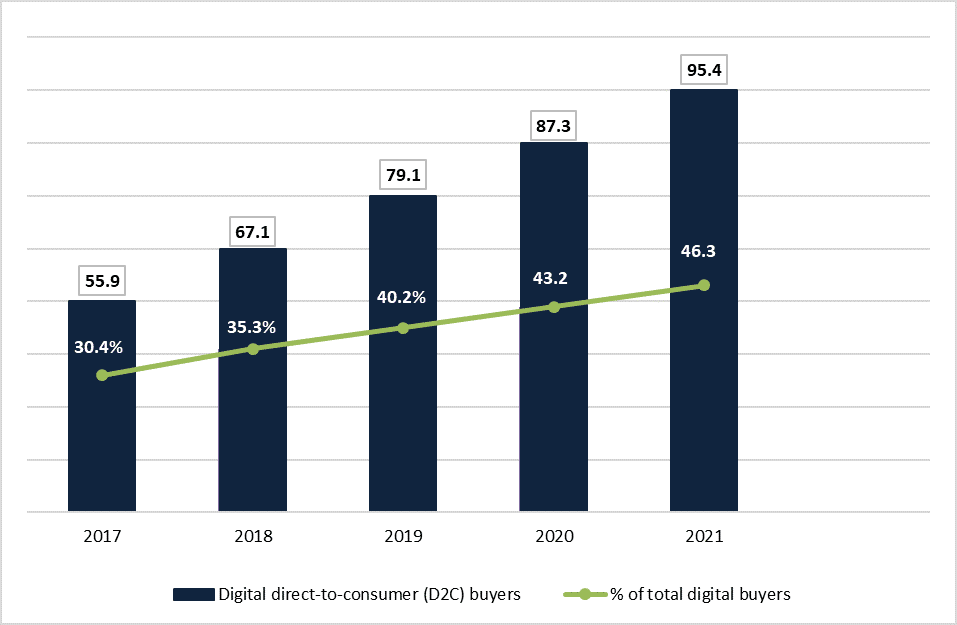

eMarketer estimates that DTC sales will grow 24% in 2020. While this is significant growth, it actually represents a slowdown from the previous five years where DTC grew three to six times the rate of overall ecommerce sales. Still, DTC continues to represent a fast growing segment in retail. There are some potential headwinds (aren’t there always?) including increased competition and a difficult economic landscape but this shouldn’t limit the great long-term potential of DTC brands. The chart below shows the trajectory of this growing segment:

US D2C Digital Buyers, 2017-2021 millions, % of total digital buyers

Note: ages 14+; internet users who have made at least one purchase from a D2C brand via their self-branded ecommerce site or app during the calendar year, including online, mobile and tablet purchases

Source: eMarketer

There are DTC opportunities for brands of any size. Disruptive brands capitalized on this trend in recent years and have had great success. But even big brands such as PepsiCo, with “pantryshop.com,” and Kraft Heinz, with “Heinz to Home,” cannot resist. Use the right data, get to know your target customer, map the purchase journey, personalize the user experience and develop a strong brand message. And don’t try to be everything to everyone. You need to carve out your niche. But while all of this is critical, lasting success will only come with a great product that captures the imagination of the consumer

Should Amazon be Part of Your DTC Strategy?

At some point, most DTC companies deal with this question. As a sales channel, Amazon does offer a way to rapidly grow and build customer relationships. Many DTC companies that decide to sell through Amazon cite increasing customer acquisition as the biggest reason – it’s the largest marketplace – that’s where the customers are. As an Amazon seller, you become part of the Amazon experience that attracts a large audience of loyal shoppers. It can be a powerful marketing tool.

But there are a number of considerations. When you sell through Amazon, you give up some control. Brand messaging can be more difficult and your customer data, which can be valuable in continuing to shape your customer relationship and improve your product, may be limited. You are subject to high Amazon fees and maybe more importantly, Amazon’s whims. And there are concerns that Amazon uses data about independent sellers on the platform to develop competing products. According to a survey of brands by Modern Retail, over 70% said they believe Amazon puts its interest above theirs.

For DTC companies that choose to do business with Amazon and have the infrastructure in place, you may try MFN (Merchant Fulfilment Network) vs FBA (Fulfilment by Amazon). In this way, you maintain more control and avoid the high fees. While you will not be eligible for Prime, your brand management and margins may be more important to you. For those DTC companies still unsure, you may consider a more limited initial strategy where you use the Amazon Marketplace for lead generation by listing only a few select products. It may not be the right fit for every brand so it is important to address the pros and cons, particularly in the context of your product position and future growth plans.

A Thought on Retail Stores

Many DTC companies develop their brand online; however, many of these same brands eventually open retail stores and it is anticipated such companies will open hundreds of retail locations over the next several years. Why? Because physical stores raise awareness, develop the brand and help drive sales as online competition heats up and digital advertising becomes more expensive. It is also where the overwhelming majority of retail sales still take place.

Retail stores have encountered a number of challenges including space saturation, the growth of ecommerce and a difficult economic landscape in 2020. It makes sense that, once again, we hear many saying this is the end of the physical store. This isn’t the first time and has been a theme for more than a decade. Yes, 2020 has been an especially hard time for retail but before we write the ending to the physical store, let’s consider some facts –

- Of the top 50 online retailers, nearly all operate stores.

- Industry wide, online sales make up less than 15% of all retail sales

- For each company closing a store, there are five opening stores

With that said, retailers have challenges, especially those primarily dependent on generating revenue from retail stores. But in a difficult environment, retailers are adapting from having customers pick up online orders at the store to contactless checkout to virtual appointments. The speed of future market growth and the success of retail stores, in general, will depend on creativity, flexibility and the ability of companies to transform the industry on behalf of the customer. Don’t write that final chapter just yet.

Contact Us

As always, for further guidance and assistance, please reach out to your PKF O’Connor Davies engagement team members or:

Gabe Lengua, CPA

Partner

glengua@pkfod.com | 646.449.6364