While it may not seem like it, there were a handful of green shoots in the third quarter that cause us to be cautiously optimistic about 2024 (despite executive sentiment reflecting more of a “grey sky” scenario, at least in the near-term). Several economic indicators point to a cooling economy and disinflationary environment – the former, generally not something to celebrate, but after 11 consecutive rate hikes by the Fed any sign of taming inflation is seen as a positive for the M&A market. Additionally, companies and customers across the chemicals value chain successfully reduced inventories while firming up their supply chains. We expect volume pressure and margins to improve as companies continue destocking efforts throughout the fourth quarter and into 2024.

Notwithstanding the above, the key themes across the chemicals sector remain largely unchanged from the second quarter. China’s recovery has shown modest improvements in domestic demand, chemical production and exports but is otherwise sluggish compared to initial expectations. Geopolitical uncertainty continues to drive global feedstock and energy costs upwards. And, headwinds from high inflation, credit tightening and recessionary fears persist. Unsurprisingly, the concerns impacting the sector have not materially shifted from those expressed last quarter.

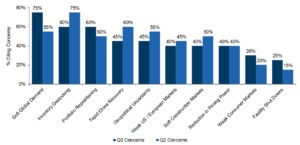

We have reviewed the latest earnings releases and transcripts from companies across the chemicals value chain. Destocking, previously cited as a concern in 75% of second-quarter earnings releases that we reviewed – the most by far – was cited in 60% of third-quarter releases, weighing to companies’ abilities to continue reducing inventory that was built up throughout the pandemic. Significant effort is required to continue reducing inventories across end-markets as soft demand and global energy and feedstock costs continue to put downward pressure on prices and compress margins. Other concerns included cost reductions through portfolio optimization, geopolitical uncertainty and capacity constraints, to name a few. (See chart below.)

Most Commonly Cited Concerns Impacting the Chemicals Sector

Source: Public chemicals company earnings releases and transcripts.

Note: Reflects percentage of chemicals executives citing concerns currently impacting their industries.

Sample size = 20.

Market Update

The higher-for-longer interest rate environment showed signs of stabilizing in the third quarter as the Federal Reserve held its benchmark Federal Funds rate steady at a floor of 5.25%, the same level since July. Owing to the Fed’s decision to hold rates steady was an ease in headline inflation, with the Consumer Price Index slowing in October to 3.2% (4.0% excluding volatile fuel and food prices), down from 3.7% in September.

The Consumer Confidence Index also reversed its second quarter trend, with U.S. consumer confidence declining moderately in October to 102.6 (1985=100), down from an upwardly revised 104.3 in September, marking three consecutive months of decline.

Lastly, the U.S. manufacturing sector contracted for the 12th consecutive month in October, with the ISM Manufacturing Purchasing Managers’ Index registering 46.7%, down from 49.0% in September, reversing three months of positive change. (Anything less than 50 indicates a contraction.)

While disinflation has been observed across countries, rising geopolitical tensions in the Middle East since the start of the Israel-Hamas war threaten to significantly impact oil prices and commodities more broadly. Additionally, global food shortages, both from disruptions of grain shipments resulting from the Russia-Ukraine war but also severe weather events, including El Nino, could have a direct impact on crop yields, food prices and, ultimately, central banks’ goals of taming inflation.

According to the American Chemistry Council (ACC), U.S. chemicals volumes are expected to recover in 2024 as inventories have been reduced and destocking is largely completed across most value chains. “We think [destocking] has pretty much played out but demand remains relatively weak. We are starting to see some green shoots of firming demand in certain areas but it’s early days,” said Martha Moore, Chief Economist of the ACC. “In the U.S., restocking activity for basic chemicals and synthetic materials used in a wide variety of manufactured goods picked up a bit in September following a prolonged period of destocking. The gain was offset by lower output of specialty chemicals, however,” said Moore.

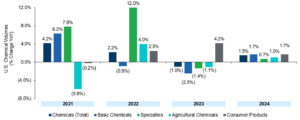

Raw material feedstock deflation helped offset volume losses across sectors, albeit modestly. Chemical output volumes are expected to fall to 1.0% in 2023, with a year-over-year decline in all segments except consumer products. (See chart below.)

U.S. Chemical Volume Output and Forecast

Source: The American Chemistry Council’s 2023 Year-End Situation & Outlook.

Declines in petrochemicals and organic intermediates, synthetic rubber and manufactured fibers led basic chemicals output to fall 2.5% in 2023. Coatings and resins declines drove specialty chemicals output down by 1.4% and declines in fertilizers and crop protection chemicals weighed on the agricultural sector, which is expected to contract 1.1% in 2023. Consumer products was the bellwether amongst chemical sectors, with increased consumer spending resulting in a year-over-year gain of 4.2% in 2023. Volumes are expected to rebound 1.5% in 2024 with gains in all major segments, according to the ACC.

Outlook

Several metrics and underlying data point to fundamental industry improvements, but the outlook for the fourth quarter and further into 2024 is mired in uncertainty and volatility. Executive sentiment, as shared in third-quarter earnings releases, falls somewhere between what we would describe as static to moderately concerned – short of our cautiously optimistic outlook leading us to conclude that the long-delayed earnings recovery has been further pushed out into 2024.

- Albert Chao – President & CEO, Westlake: “This volatile economic backdrop, combined with ongoing geopolitical turmoil and an almost seasonal decline in demand, leads us to expect challenging conditions to continue throughout the fourth quarter. The uncertain macroeconomic outlook makes it difficult to predict demand trends over the next several quarters.”

- Lori Ryerkerk – Chairman, President & CEO, Celanese: “I would say based on conversations with customers, I would expect some moderate growth across next year as we start to see some demand coming back. But I would also say the timing of when that starts and the pace at which that happens is very uncertain.”

- Conrad Keijzer – CEO, Clariant: “While we expect to see an easing inflationary environment, we do not expect an economic recovery in the final three months of 2023.”

- Peter Vanacker – CEO, LyondellBasell Industries: “…we expect that challenging market conditions will persist through the remainder of the year and into 2024…Integrated polyethylene margins will likely be constrained by higher feedstock costs and new market capacity. We expect that European markets will remain highly challenged. Weak market demand, coupled with rising feedstock and energy costs, are likely to continue to compress margins.”

- Christian Kullman – Chairman & CEO, Evonik Industries: “…the global economy and the situation of the chemical industry has not improved since our last call. Demand still remains weak and it’s even weakened further in some areas.”

- James Fitterling – Chairman & CEO, Dow: “…we’re continuing to see strength in areas like telecommunications and data centers. Automotive, even in the face of the strikes, is holding up relatively well and our view is that it should bounce back…I think that we’re positioned that once the weight of inflation starts to moderate, that things start to turn back in a positive direction, and our view is that we could be in better shape for 2024.”

Despite the current backdrop and uncertain future, the longer-term outlook for the U.S. chemicals sector is positive, with the Gulf Coast advantaged feedstock position favoring U.S. production for the foreseeable future. Additionally, the ACC’s Martha Moore noted that “capacity expansions in customer industries motivated by recent legislation (e.g., IRA, IIJA, CHIPS) and re-/near-shoring of manufacturing to North America will support U.S. chemistry going forward… with competitive energy fundamentals and the resurgence in U.S. manufacturing from once-in-a-generation legislative initiatives to promote clean energy, infrastructure, and a strong domestic manufacturing base.”

M&A Landscape

In the third quarter deal activity and valuation multiples for private company chemicals transactions increased, according to GF Data, though this can be misleading as the data is only representative of companies and transactions that were reported to the site. The average transaction multiple for 2022-2023 was 7.9x EV/EBITDA, significantly above the 10-year average of 7.2x. It’s worth noting that in prior GF Data reports, no 2023 metric was provided for private chemicals transactions. In our second-quarter update, the average transaction multiple for 2022 was 7.1x, leading us to conclude that deals in 2023 were well above 7.9x, though, again, this can be misleading and disproportionately skewed to one or two transactions. (See chart below.)

Private Middle-Market Chemicals Manufacturing Transaction Multiples Over Time

Source: GF Data

Note: Private chemicals manufacturing transactions with $10 million to $250 million total enterprise value. Includes private sponsor buyouts.

In the broader chemicals and global M&A market, there hasn’t been much to celebrate in 2023. But investors are coming to terms with the higher-for-longer interest rate environment and expect it will be the second half of 2024 before a potential rate cut by the Fed.

High-quality assets continue to garner outsized interest as more and more investors are chasing fewer and fewer premium opportunities. Private equity firms are increasingly under pressure to exit long-held portfolio companies, return capital to LPs and deploy dry powder, though the latter is a far less concern than the former given the current environment and limited high-quality investment opportunities in the market. Moreover, the higher cost of capital has forced private equity firms to contribute more equity in transactions, lowering their return targets. But this isn’t necessarily bad for all parties. According to the Association for Corporate Growth (ACG), “because of high interest rates and lower leverage, sponsors are often putting more equity into a deal or engaging minority stake investors, which M&A experts think is a net positive for companies and gives them more confidence. At the same time, seller valuation expectations are starting to come down to more normalized levels.”

While a host of factors have contributed to the tepid M&A market in 2023, investors know they can’t sit on the sidelines forever. Based on the increasing rate of inquiries we’ve been receiving from clients, we expect to see a modest uptick in deal activity in the first half of 2024.

Selected Recently Announced Chemicals Transactions

(in U.S. millions) | ||||||

Ann. Date | Target | Acquirer | Description | Transaction Value ($mm) | EV / | EV / |

Oct-23 | Lucas Meyer Cosmetics Canada | Clariant AG | Cosmetic and personal care chemical developer and manufacturer offering anti-aging cream, hair loss treatment, and more | $810 | 8.10x | 16.3x |

Oct-23 | Advanced Organic Materials (AOM) | Kensing, | Supplier of non-GMO plant-based vitamin E, mixed tocopherols and phytosterols derived from sunflower and rapeseed out of facilities in Spain and Argentina | — | — | — |

Sep-23 | Eastman Chemical | INEOS | Business and assets related to Texas City operations including 600kt acetic acid plant and exploration of long-term supply agreement for vinyl acetate monomer | $490 | — | — |

Sep-23 | Seiko PMC | The Carlyle Group | Tokyo-listed paper and ink chemicals manufacturer | $233 | 1.07x | 11.1x |

Aug-23 | Dupont Delrin | TJC | 80.1% stake in Delrin resins unit, an acetal homopolymer with higher tensile strength used as a substitute for metal parts | $1,600 | — | — |

Aug-23 | Delmar | Minafin | Portfolio of generic active ingredients and Montreal, Canada site that includes R&D, industrial transposition and commercial manufacturing resources | — | — | — |

Jul-23 | Chase Corp | KKR | Global manufacturer of protective materials for high-reliability applications including electronics, fiber optics and electric grid infrastructure | $1,300 | 3.32x | 13.0x |

Jul-23 | Siemens AG Process | Valmet Corp | Process gas chromatography platform used to measure the chemical composition of gases and evaporable liquids in all stages of production | $115 | 0.85x | 8.5x |

Jul-23 | Fabbrica Italiana | Bain Capital | Privately-owned developer and manufacturer of small molecule active pharmaceutical ingredients (APIs) and intermediates | — | — | — |

Jul-23 | AkzoNobel XPS | Hirsch Porozell | Extruded polystyrene insulation production site in Romania used primarily where extreme pressure and moisture stresses are present | — | — | — |

Jul-23 | Novachem (Argentina) | Evonik | Portfolio of biotechnological, natural and sustainable cosmetic active ingredients | — | — | — |

Source: FactSet, PitchBook and other publicly available information.

Note: Dollars in U.S. millions.

About PKF Investment Banking

PKF O’Connor Davies Capital LLC (DBA PKF Investment Banking) is the investment banking affiliate of PKF O’Connor Davies. Securities-related transactions are processed through an unaffiliated broker dealer, Burch & Company, Inc.

The PKF Investment Banking team has completed over 250 M&A advisory and capital raise engagements in North America and abroad. Companies and business owners across a range of industries rely on our transaction and sector expertise, global reach, confidentiality and utmost integrity to help them achieve their objectives. We focus on privately held companies and have extensive knowledge with decades of experience advising middle-market businesses. Our key services include sell-side and buy-side M&A advisory, exit readiness and transaction planning.

The PKF Investment Banking team has advised on numerous, successful transactions in the chemicals sector in the private and public markets. Our chemicals experience encompasses a variety of sub-verticals across the chemicals value chain, including chemical distribution, commodity chemicals, differentiated chemicals, specialty chemicals, pigments and additives, coatings and adhesives and agchems and fertilizers.

Contact Us

- Robert Murphy

Senior Managing Director

PKF Investment Banking

rmurphy@pkfib.com | 561.337.5324

Disclaimer

PKF Investment Banking provides this report for information purposes only and it does not constitute the provision of financial, legal or tax advice or accounting or professional consulting services of any kind. Securities-related transactions are processed through an unaffiliated broker-dealer, Burch & Company, Inc.