The uplift in the chemicals sector in the first half of 2023, largely expected from China’s reopening of its economy following restrictive COVID lockdowns, did not materialize, diminishing the optimistic outlook on which a recovery was predicated. As a result, U.S. chemicals companies, most notably commodity companies, are heavily weighted on the second half of 2023 earnings expectations. Given their exposure to construction and other seasonal sectors, it is unlikely that a second-half recovery will materialize. While customer-level destocking continues, it has not occurred at levels needed to meaningfully increase volumes, which would likely require a recovery in global markets, most notably in China.

With the exception of a few bright spots, volume declines continued throughout the second quarter of 2023 across chemicals end-markets. Companies have retained some level of selling price increases to customers helping to offset declining volumes, but lower demand coupled with global energy and feedstock costs are putting downward pressure on prices across the chemicals value chain.

While U.S. industrial activity remains weak, consumers are still spending. According to The Conference Board Consumer Confidence Index, U.S. consumer confidence improved in July to 117 (1985=100), its highest level in two years after a second straight month of gains. High consumer spending and a robust labor market have complicated the Fed’s efforts to cool the economy and tame inflation, with another quarter percentage point rate hike announced at the July Federal Open Market Committee (FOMC) meeting, raising the Federal Funds rate to a floor of 5.25%.

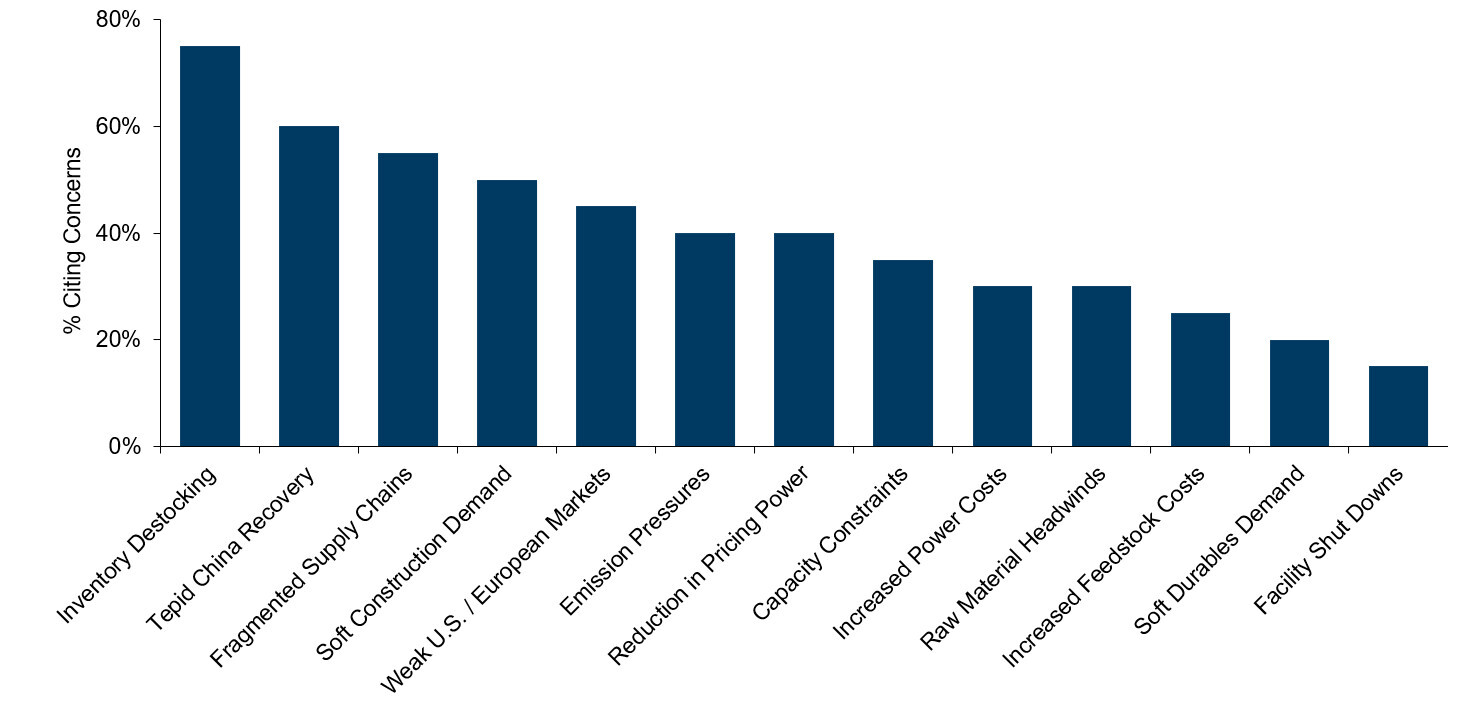

A muted economic recovery and high inflation are just a couple of a host of factors that impacted the chemicals sector in the first half of 2023. We have reviewed the latest earnings transcripts from several publicly traded companies across the chemicals value chain. Customer inventories, China softness and fragmented global supply chains were the most commonly cited concerns facing the chemicals sector, as expressed by CEOs and executives in their latest quarterly announcements. (See chart below.)

Most Commonly Cited Concerns Impacting the Chemicals Sector

Source: Public chemicals company earnings releases and transcripts.

Note: Reflects percentage of chemicals executives citing concerns currently impacting their industries. Sample size = 20.

Despite the many headwinds facing the industry, most clients we spoke with believe we are closer to a bottom than we were six months ago and that an anticipated recession is likely to be shorter and less severe than originally thought. Below, we outline the key themes we have seen impacting our clients across the chemicals value chain.

Current Themes in the Chemicals Sector

1. China Reopening SoftnessA rebound in Chinese import demand and consumer spending has yet to materialize, diminishing the optimistic outlook on which the chemicals recovery was predicated. A Chinese stimulus program could provide a second-half uptick, though its effects would take time to move chemical prices and likely provide a boost mainly to construction and real estate end-markets. U.S. commodity chemicals companies are positioned to benefit most from an increase in Chinese demand.

2. Geopolitical Uncertainty

Russia-Ukraine War – The ongoing Russia-Ukraine war has resulted in elevated global feedstock and energy costs, continuing to impact chemical producers and manufacturers, most significantly in Europe which has become one of the highest cost regions in the world. The European fuel market remains tight, but a mild winter and increased LNG imports from the U.S. helped alleviate what otherwise would have resulted in storage inventories well below five-year averages. The energy crisis has caused power prices to rise by more than 100% in many European countries.

Reshoring – In the aftermath of COVID-19, ongoing geopolitical uncertainty and the resulting fragmented supply chains that ensnarled global trade, chemicals companies have continued to mitigate their exposure by shifting operations closer to home or to more geopolitically secure locations. Chinese decoupling is not a realistic strategy for companies operating globally across the chemicals value chain, but across industries we are seeing clients seek to de-risk their exposure to China. Reshoring (or near-shoring) has the potential to drive deal activity as acquirers reshape their geographic footprints, realign supply chains and look to build redundant manufacturing capabilities in the U.S. where feedstock and energy costs are relatively cheaper. M&A is often the preferred approach to achieving this as greenfield investment can carry significant risk, cost and time delays.

3. Macro Headwinds

Persistently High Inflation – The “higher-for-longer” interest rate environment has resulted in weaker-than-expected demand and represents a potential new baseline for rates. The Fed pause – a break in interest rate hikes after 10 consecutive raises – was a signal to many of peaking inflation. But with high consumer spending and low unemployment, the Fed raised rates for the eleventh time since March of 2022 at its July FOMC meeting and signaled there may be another rate increase before the year ends to bring inflation in line with its target of 2%.

Credit Tightening – The regional bank failures in the first half of 2023 of First Republic Bank, Silicon Valley Bank and Signature Bank, followed by the collapse of Credit Suisse and subsequent sale to UBS, exacerbated concerns around credit availability, especially as loan standards were already tightening heading into the Spring. This tightening looks set to continue in the second half of the year, increasing the cost for small and midsize businesses to secure funding and resulting in an increasingly higher cost of capital to fund transactions. (See Rising Cost of Capital below.)

Prolonged Recessionary Fears – The chemicals industry is one of the best leading indicators for the global economy, as it is the third largest industry in the world after energy and agriculture and its products are used in a variety of diverse end-markets in countries around the world. While the likelihood of a prolonged and severe recession appears less than originally anticipated, recent earnings results highlight that a downturn is still underway across the chemicals industry with minimal relief in the near-term:

- Dow, Q2 2023 Earnings Update: “Volume down 8% YoY; Price declined 18% YoY and 5% QoQ; Pricing declines in all operating segments and regions due to lower demand and global energy and feedstock costs.”

- Ashland, Q3 2023 Earnings Transcript: “Total sales for the quarter declined 15% compared to the prior year… The unprecedented recent impact from customer destocking actions across many supply chains continues to materially impact many of the markets we serve… Until the inventory control actions taken by our customers have subsided, it will remain difficult for us to gauge the true end-market demand.”

- Huntsman, Q2 2023 Earnings Transcript: “Our biggest problem today is simply demand. While we do not expect any sudden improvements in the second half of the year, we do see green shoots in many areas of North America and China, but less so in Europe.”

- Olin, Q2 2023 Earnings Transcript: “Global market conditions continue to be quite poor. Additionally, our performance in the second quarter was not up to expectations… In the third quarter, we expect epoxy resins and system sales volumes to slightly improve relative to the second quarter. However, inventory reduction efforts will leave the business in negative EBITDA territory.”

4. Evolving Industry Dynamics

End-Market Fundamentals – U.S. housing and construction (particularly commercial), industrial manufacturing and other capex-intensive end-markets are likely to remain soft in the near-term, primarily affected by higher interest rates. Chemicals companies serving defense or select cyclical industries (aerospace and defense, consumer staples), with strong pricing power and industry structures should withstand an economic downturn with only modest impacts on profitability. Softness in electronics, consumer durables and construction will likely linger into the second half of 2023/first half of 2024 offsetting growth in the water, healthcare and aerospace end-markets. Autos, aerospace and defense and coatings (despite construction exposure) remain bright spots YTD. Packaging, specialty plastics and resin demand have likely bottomed and could experience a modest recovery in the second half of 2023/first half of 2024.

Destocking and Inventory Management – Customer-level destocking continues across industries, but it has not materialized as quickly as companies had hoped. U.S. Census Bureau data showed that channel inventories continued to rise in May for both wholesalers and retailers driven by machinery equipment, metals and mining and chemicals. Compared to 2015-2019 averages, durable goods distributors are holding an extra 11% of inventory on average. The manufacturing inventories-to-sales ratio fell slightly in May but remains elevated vs. pre-pandemic levels. Manufacturers continue to hold excess inventory in response to the volatility of global supply chains. To counter tepid demand and increased inventories, chemicals companies are refocusing efforts on cost actions, operating rate reductions and working capital management (reducing inventories where possible, collecting payments quicker) as a source of cash to fund potential investments or acquisitions.

Pricing Power, Weak Demand and Oversupply – As raw material costs remained elevated over the past two years, U.S. chemicals companies retained unprecedented levels of selling price increases. High oil and natural gas, heating and consumer goods prices resulted in record profits for petrochemicals companies in 2022. While this helped to offset the historically low volumes, prices are now coming under greater pressure. Continued soft domestic demand and weakened export demand have resulted in feedstock deflation, putting downward pressure on prices in caustic soda, polyethylene, polypropylene, chlor-alkali, acetyls and derivatives and epoxy and PVC chains. While several projects have been delayed, global ethylene and polyethylene capacity additions are expected, contributing to an already oversupplied market and continuing to pressure U.S. chemicals prices in the near-term.

M&A Landscape

Despite the numerous headwinds facing the chemicals sector and broader market, transactions are happening, just on a more selective basis. Higher interest rates, credit tightening, macro and geopolitical concerns and recessionary fears continue to drive multiple compression for larger deals. Middle and lower middle market deal activity, while still impacted, have proven much more resilient in 2023 due to smaller transaction sizes with less reliance on financing. While global M&A activity and valuations have fallen from 2021 peaks, favorable market conditions remain that facilitate ample opportunities: highly fragmented and profitable industries supported by strong company balance sheets, portfolio repositioning and significant private equity dry powder.

Below are the key trends we see impacting the chemicals M&A landscape in 2023.

- Flight to Quality – Ongoing global and market uncertainty coupled with higher transaction costs have created a massive “flight to quality” resulting in a highly competitive market with fewer but higher quality transactions and more strategic buyers and investors seeking above average performers with resilient businesses.

- Increased Use of Earnouts and Seller Notes – To help bridge the valuation gap between buyers and sellers and to drive additional value for achieving targeted operating and financial performance, earnouts are increasingly becoming more common in transactions, especially in middle market and lower middle market M&A – a trend that was popular throughout the pandemic but has continued to increase since. According to SRS Acquiom’s 2023 M&A Deal Terms Study, 21% of M&A deals in 2022 included earnouts (vs. 19% in 2020 and 17% in 2021), with a greater occurrence in smaller, private deals valued at $250 million and below. In 2022, the median earnout as a percentage of total transaction value was 31% and the median earnout period had increased to 24 months (from 22.5 months in 2021). We have also seen an uptick in transactions involving seller notes, an alternative capital structure that gives the buyer confidence in the seller achieving its targets while also providing financing flexibility.

- Rising Cost of Capital – According to ACG, the average pricing on senior debt for middle-market, private equity-backed transactions in the first half of 2023 was 8.1%. That’s the highest level since it began tracking in the beginning of 2007 and significantly above the 6.7% average in the fourth quarter of 2022. Subordinated debt similarly saw a 2.0% increase. The higher cost of capital is forcing private equity firms to contribute more equity in transactions, lowering their return targets. With record private equity dry powder and fewer investment opportunities in the market, more and more funds are chasing fewer and fewer assets to deploy capital. (See Flight to Quality.)

- Portfolio Repositioning and Shedding of Non-Core Assets – Given market uncertainty and soft end-market demand, many companies are focusing efforts on repositioning their businesses by divesting non-core assets, reshaping geographic footprints and moving manufacturing operations closer to home. Companies are actively realigning operations to focus on businesses where they have advantaged positions of scale. There is a continued push for differentiated chemicals companies to shift exposure from non-core or volatile, commodity-based businesses to higher performing, value-added specialty businesses. Larger corporates are shedding non-core assets to avoid the conglomerate valuation discount that equity markets have ascribed (Chemours’ sale of its Glycolic Acid business to Puretech Scientific; Entegris’ sale of its Electronic Chemicals business to Fujifilm; Venator’s sale of its Color Pigments business to Oxerra; ITW’s sale of its Polymer Sealants business to Holcim; Huntsman’s sale of its Textile Effects business to Archroma; Evonik’s sale of its U.S. Betaine business to Kensing, to name a few).

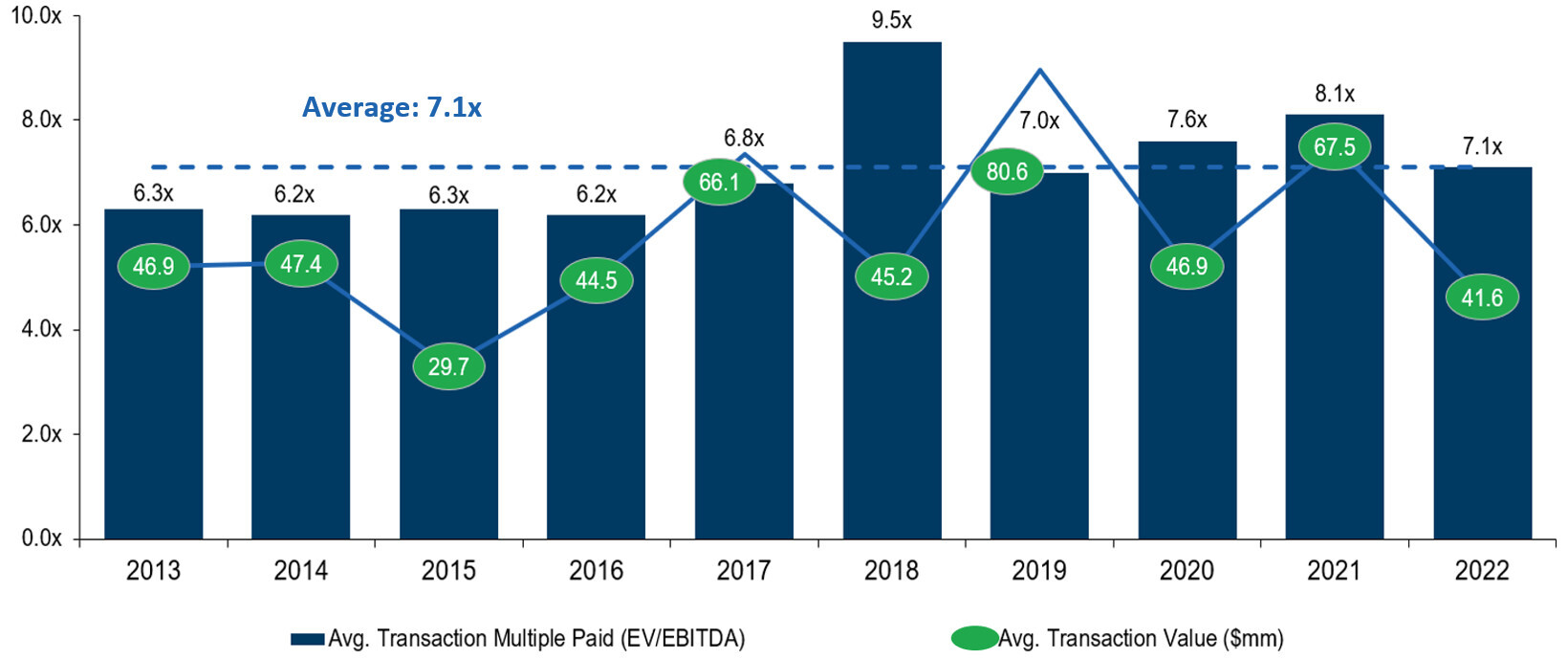

So, what does this all mean for private company transactions in the chemicals sector? Due to a variety of factors previously described, deal activity and valuation multiples have come off of their 2021 peaks. We are seeing multiple compression on average of one to two turns on an Enterprise Value-to-EBITDA basis; however, even with the significant headwinds facing the industry, transaction multiples for private chemical manufacturing deals in 2022 were in line with their 10-year average of 7.1x EV/EBITDA. (See chart below.)

Private Middle Market Chemicals Manufacturing Transaction Multiples Over Time

Source: GF Data

Note: Private chemicals manufacturing transactions with $10 million to $250 million total enterprise value. Includes private sponsor buyouts.

Selected Recently Announced Chemicals Transactions

(in U.S. millions) | ||||||

Ann. Date | Target | Acquirer | Description | Transaction Value ($mm) | EV / | EV / |

Jul-23 | AkzoNobel XPS Insulation Business | Hirsch Porozell | Extruded polystyrene insulation production site in Romania used primarily where extreme pressure and moisture stresses are present | – | – | – |

Jun-23 | Covestro | ADNOC | Advanced material for electric vehicles and thermal insulation for building, coatings, adhesives and engineered plastics | 12,400 | 0.70x | 11.2x |

Jun-23 | Chemours Glycolic Acid Business | Puretech Scientific, Iron Path Capital | U.S. glycolic acid assets used in organic synthesis of ultra-high purity alpha hydroxy acid for life sciences and specialty chemicals | 137 | – | – |

May-23 | Braskem (Novonor 34.4% stake) | Unipar Carbocloro | Unsolicited offer to acquire 34.4% of Novonor’s (fka Odebrecht) minority stake in Braskem, a global petrochemical manufacturer of PE and PP | 1,132 | – | – |

May-23 | Livent | Allkem | All-stock merger of equals to create global integrated lithium chemicals producer | 3,801 | 4.12x | 7.8x |

May-23 | Entegris Electronic Chemical Business | Fujifilm | High purity process chemicals used to etch and clean silicon wafers in the production of semiconductors | 700 | – | – |

May-23 | Braskem (Novonor 38.3% stake) | Apollo, ADNOC | Unsolicited offer to acquire 38.3% of Novonor’s (fka Odebrecht) minority stake in Braskem, a global petrochemical manufacturer of PE and PP | 691 | – | 6.7x |

Apr-23 | Venator Color Pigments | Oxerra (fka Cathay Industries) | Iron oxide pigment business used in coatings, plastics, construction and specialty markets; includes eight global manufacturing sites | 140 | – | – |

Mar-23 | Diversey | Solenis | Provides cleaning and hygiene products in the hospitality, health care, food and beverage and facility management sectors | 4,600 | 1.66x | 13.3x |

Mar-23 | Univar Solutions | Apollo | Global specialty chemicals and ingredients distributor | 8,165 | 0.71x | 8.1x |

Feb-23 | IFF Flavor Specialty Ingredients Business | Exponent | Manufacturer of synthetic and natural aroma based chemical used in the flavor market | 220 | – | – |

Feb-23 | ICP Industrial Solutions Group | Stahl | High-performance coatings used in packaging and labeling applications, primarily in the food and pharmaceutical sectors | 205 | 1.40x | – |

Nov-22 | The Stoller Group | Corteva | Biologicals and crop protection technologies | 1,200 | – | 12.0x |

Oct-22 | ITW Polymers Sealants | Holcim | Provider of coating, adhesive and sealant solutions in North America | 220 | – | – |

Aug-22 | Huntsman Textile | Archroma | Manufacturer of dyes and textile chemicals | 718 | 0.93x | 7.6x |

Aug-22 | Evonik U.S. | Kensing, | U.S. Betaine business used as ingredients in the formulation of shampoos, hair conditioners and skin care products | – | – | – |

Note: Dollars in U.S. millions.

About PKF Investment Banking

PKF O’Connor Davies Capital LLC (DBA PKF Investment Banking) is the investment banking affiliate of PKF O’Connor Davies. PKF O’Connor Davies Advisory LLC is a member firm of the PKF International Limited network of legally independent firms and does not accept any responsibility or liability for the actions or inactions on the part of any other individual member firm or firms. Securities-related transactions are processed through an unaffiliated broker dealer, Burch & Company, Inc.

The PKF Investment Banking team has completed over 250 M&A advisory and capital raise engagements in North America and abroad. Companies and business owners across a range of industries rely on our transaction and sector expertise, global reach, confidentiality and utmost integrity to help them achieve their objectives. We focus on privately held companies and have extensive knowledge with decades of experience advising middle-market businesses. Our key services include sell-side and buy-side M&A advisory, exit readiness and transaction planning.

The PKF Investment Banking team has advised on numerous, successful transactions in the chemicals sector in the private and public markets. Our chemicals experience encompasses a variety of sub-verticals across the chemicals value chain, including chemical distribution, commodity chemicals, differentiated chemicals, specialty chemicals, pigments and additives, coatings and adhesives and agchems and fertilizers.

Contact Us

- Robert Murphy

Senior Managing Director

PKF Investment Banking

rmurphy@pkfib.com | 561.337.5324

Disclaimer

PKF Investment Banking provides this report for information purposes only and it does not constitute the provision of financial, legal or tax advice or accounting or professional consulting services of any kind. Securities-related transactions are processed through an unaffiliated broker-dealer, Burch & Company, Inc.