The fourth quarter of 2023 continued to prove a challenging environment for the chemical industry in a year that was characterized by significant macroeconomic and geopolitical headwinds, unprecedented inventory levels across end markets and unpredictable demand weakness that put downward pressure on volumes and prices. Companies across the chemicals value chain focused their efforts on levers which they could control: disciplined cost reductions through overhead eliminations, plant shutdowns, performance improvements and portfolio optimization. Inventory destocking, which began in late 2022 and has mostly returned to normalized levels across industries, was also a significant focus in 2023. The overwhelming sentiment of chemical executives is that businesses are streamlined and well-positioned for a recovery, whenever that may occur.

According to the American Chemistry Council (ACC), chemical production closed the year on a modest upswing, both globally and in the U.S. The Global Chemical Production Regional Index (CPRI), which measures the production volume of the chemical industry for 55 key nations, sub-regions and regions, was 0.1% higher in December (MoM), following a revised 0.5% gain in November. The U.S. CPRI rose 0.4% in December (MoM), following a 0.3% decline in November. Martha Moore, ACC’s chief economist said:

The gain in December was led by North America and Asia-Pacific. Even though global production was higher on a year-over-year basis, Europe continued to see weakness as production remained below last year’s level…. In the U.S., chemical output rose in all regions except the Gulf Coast. There were signs of recovery in the output volumes of agricultural and coatings and other specialty chemicals that offset ongoing weakness in basic industrial chemicals and synthetic materials.

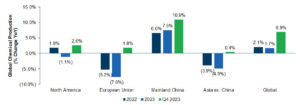

In 2023, global chemical production grew by 1.7% year-over-year driven by the considerable increase in Chinese production of 7.5%, owing to domestic demand and export recovery. While much improved from the prior year, 2023’s increase was from a very low baseline due to the COVID-related lockdowns in China and tepid recovery. All other regions experienced a decline in 2023, according to Martin Brudermüller, Chairman of the Board of BASF. On BASF’s latest earnings call, Brudermüller highlighted:

In Europe and Asia, excluding China, chemical production decreased substantially due to lower demand resulting from high inflation front-loading of durable good consumption during the COVID years, as well as structurally higher natural gas prices…. Natural gas prices in Europe are still around double the average between 2019 and 2021, and five times higher than the Henry Hub quotation. In North America, chemical production declined slightly, compared with 2022, in an environment of weak domestic demand from industries and end consumers.

Global Chemical Production Rates

Source: BASF Q4 2023 earnings presentation.

Note: Q4 2023 figures partly based on BASF estimates. Growth rates for regional aggregates might differ from official data releases due to different country coverage and weights.

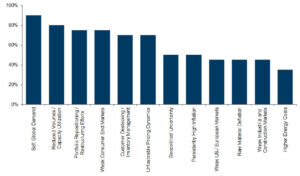

In the latest quarterly earnings releases and transcripts, chemical executives noted that demand and competitive challenges were easing in certain products, end markets and geographies, but they did not anticipate meaningful sequential improvement in volumes or prices in the first quarter of 2024. Executives cited soft global demand and volume reduction most frequently as having the greatest impact on their businesses in the current environment. Other commonly cited factors included portfolio repositioning, weak end markets, customer-level destocking and unfavorable pricing dynamics. The chart below highlights the top 12 factors that were cited as having the greatest impact on chemical companies today.

Most Commonly Cited Factors Impacting the Chemicals Sector

Source: Public chemical company earnings releases and transcripts.

Note: Reflects percentage of chemical executives citing concerns currently impacting their industries.

Sample size = 20.

Outlook – Cautiously Optimistic

Companies mostly reported modest improvements in January and February and were cautiously optimistic about the rest of the year, expecting a sequential second-quarter recovery with momentum going into the second half of the year. Given the disappointing second-half performance of 2023, however, companies were more reluctant this time around to provide an optimistic forecast for the full year.

“I’m also still a bit haunted by the ghosts of a year ago when many of you and most companies were projecting 2023 to have a weak beginning but a very strong second half. The second half proved to be nothing short of a disaster,” said Peter Huntsman, President and CEO of Huntsman. Huntsman followed:

It is still too early in the quarter to make bold predictions. However, the order patterns that I am seeing in most areas of the world tells me that in most of our divisions, we have seen the end of a very long period of inventory drawdowns, and prices and volumes look to be gradually improving…. I feel more optimistic than I did at the year-end and see more proverbial green shoots than I have over the past 12 to 18 months.

Guillermo Novo, Chairman and CEO of Ashland, provided similar sentiment:

While we are cautiously optimistic about the improving demand trends that we’re experiencing in the quarter and into January and February, there is still heightened uncertainty regarding customer demand normalization. Typically, we would be building inventory for the peak season at this time. And currently, we are not doing that build.

Investors are anxiously awaiting first-quarter results, as they will define the timing and magnitude of the recovery which companies hope they have begun to see in January and February. With customer-level destocking mostly completed in 2023, companies expect demand normalization to drive improvements in volume production and pricing, with current trends suggesting a demand recovery in the second quarter.

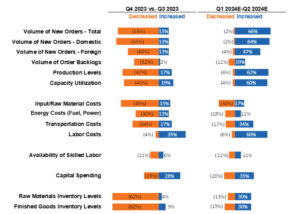

According to findings from the ACC’s Chemical Manufacturing Economic Sentiment Index (ESI) survey, which allows chemical manufacturers to provide an assessment of their own company’s activity level (e.g., sales, production, output), manufacturing activity deteriorated in the fourth quarter for the fourth consecutive time. The ESI showed that sentiment around customer demand, new orders and production levels all declined in the fourth quarter compared to the third.

The outlook for the first six months of 2024 presented a materially different picture, however. While concerns still exist around the health of the overall economy, chemical manufacturers overwhelmingly expect that the first half of 2024 will see a demand recovery with volume improvements in new orders and backlogs, production and capacity utilization. (See chart below.)

Chemical Manufacturers’ Assessment of their U.S. Business (Q4 2023 MoM Performance, 1H 2024 Outlook)

Source: American Chemistry Council Chemical Manufacturing Economic Sentiment Index.

Note: Survey responses were collected from January 8-19, 2024.

M&A Landscape

In the fourth quarter, valuation multiples for private company chemical transactions increased, driving the average transaction multiple for 2023 to 8.8x EV/EBITDA, according to GF Data. This was significantly above 2022’s average multiple of 7.1x and nearly one-and-a-half-turns higher than the 10-year average of 7.4x. (See chart below.)

Private Middle-Market Chemicals Manufacturing Transaction Multiples Over Time

Source: GF Data

Note: Private chemicals manufacturing transactions with $10 million to $250 million total enterprise value. Includes private sponsor buyouts.

Despite the low deal volume, average private company valuations across industries increased at the end of 2023, particularly for smaller transaction sizes. GF Data noted that deals valued between $10 and $25 million saw more than half-a-turn improvement in the fourth quarter, while deals valued between $25 and $50 million also saw improvement, though at a more modest level. Conversely, valuations for larger transactions declined. Private company deals valued between $50 and $100 million and those valued between $100 and $250 million both experienced a drop by a full-turn of EBITDA in the fourth quarter. Despite this observation, there remains a significant size premium for private company transactions. In 2023, valuations for private companies with $10 million or more in EBITDA averaged a turn-and-a-half higher than for those with between three and five million dollars in EBITDA, according to GF Data.

As the third largest industry in the world, the chemical industry serves as one of the best leading indicators for the global economy. It will be one of the first industries to benefit from a recovery since its materials supply manufacturing industries at the beginning of almost all value chains.

Given interest rate stabilization and anticipated cuts by the Fed, signs of an improved lending environment with significant growth in the availability of private credit – $1.7 trillion in June of 2023, up from $830 billion at the start of 2020 – record private equity dry powder and seemingly improving demand, volume and pricing fundamentals in the first couple months of 2024, we are optimistic about a second-half chemicals and M&A recovery.

Selected Recently Announced Chemicals Transactions

(in U.S. millions) | ||||||

Ann. Date | Target | Acquirer | Description | Transaction Value ($mm) | EV / | EV / |

Mar-24 | Entegris Pipeline & Industrial Materials (PIM) Business | SCF Partners | Drag Reducing Agents (DRAs) and a range of valve maintenance products and services for pipeline operations | $285 | — | — |

Mar-24 | Evonik Superabsorbents Business | International Chemical Investors Group (ICIG) | Powdered polymers used as absorbent materials in diapers and other hygiene products; includes production facilities at five locations in Germany and the U.S. | — | — | — |

Jan-24 | vanBaerle Group Specialty Silicate Business | PQ Corp | Manufacturer of high-grade silicates used for industrial welding processed | — | — | — |

Dec-23 | Iowa Fertilizer Co. | Koch Industries | Manufacturer of greenfield nitrogen fertilizers and diesel exhaust fluid | $3,600 | — | — |

Dec-23 | Thai Peroxide | Evonik | Hydrogen peroxide and peracetic acid specialties business operating in the Asia Pacific market | — | — | — |

Dec-23 | American Pacific (AMPAC) | NewMarket | North American manufacturer of critical performance additives used in solid rocket motors for space launch and military defense applications | $700 | — | — |

Nov-23 | Sio Silica | Pyrophyte Acquisition Corp (SPAC) | Canadian manufacturer and supplier of quartz silica | $708 | — | — |

Nov-23 | OWI Chlor Alkali (Old World Specialty Chemicals & Old World Logistics) | Brenntag | One of the largest independent distributors of caustic soda in North America | — | — | — |

Oct-23 | Lucas Meyer Cosmetics Canada | Clariant AG | Cosmetic and personal care chemical developer and manufacturer offering anti-aging cream, hair loss treatment, and more | $810 | 8.10x | 16.3x |

Oct-23 | Advanced Organic Materials (AOM) | Kensing, | Supplier of non-GMO plant-based vitamin E, mixed tocopherols and phytosterols derived from sunflower and rapeseed out of facilities in Spain and Argentina | — | — | — |

Sep-23 | Eastman Chemical | INEOS | Business and assets related to Texas City operations including 600kt acetic acid plant and exploration of long-term supply agreement for vinyl acetate monomer | $490 | — | — |

Sep-23 | Seiko PMC | The Carlyle Group | Tokyo-listed paper and ink chemicals manufacturer | $233 | 1.07x | 11.1x |

Aug-23 | Dupont Delrin | TJC | 80.1% stake in Delrin resins unit, an acetal homopolymer with higher tensile strength used as a substitute for metal parts | $1,600 | — | — |

Source: FactSet, PitchBook and other publicly available information.

Note: Dollars in U.S. millions.

Contact Us

Please feel free to contact us directly to discuss key trends we are seeing across the chemicals sector, or to confidentially discuss strategic plans for your business:

- Robert Murphy

Senior Managing Director

PKF Investment Banking

rmurphy@pkfib.com | 561.337.5324

About PKF Investment Banking

PKF O’Connor Davies Capital, LLC (DBA PKF Investment Banking) is the investment banking affiliate of PKF O’Connor Davies, a full-service certified public accounting and consulting firm with more than 1,500 professionals.

The PKF Investment Banking team has completed over 250 M&A advisory and capital raise engagements in North America and abroad. Companies and business owners across a range of industries rely on our transaction and sector expertise, global reach, confidentiality and utmost integrity to help them achieve their objectives. We focus on privately held companies and have extensive knowledge with decades of experience advising middle-market businesses. Our key services include sell-side and buy-side M&A advisory, exit readiness and transaction planning.

Our team has advised on numerous, successful transactions in the chemicals sector in the private and public markets. Our chemicals experience encompasses a variety of sub-verticals across the chemicals value chain, including chemical distribution, commodity chemicals, differentiated chemicals, specialty chemicals, pigments and additives, coatings and adhesives and agchems and fertilizers.

PKF Investment Banking provides this report for information purposes only and it does not constitute the provision of financial, legal or tax advice or accounting or professional consulting services of any kind. Securities-related transactions are processed through an unaffiliated broker-dealer, Burch & Company, Inc.