By Jonathan Moore, CPA, CM&AA, Partner

If you mentioned the acronym “SPAC” a few years ago you were likely met with a blank stare. While COVID-19 led the headlines in 2020, SPACs became the hottest investment vehicle on Wall Street dominating the initial public offering (IPO) landscape and private equity has played a significant role in the SPAC boom. Private equity’s contribution to the SPAC revolution is important because billions of dollars of capital are being added to an already overflowing investment war chest of “dry powder” estimated to be in excess of $1.5 trillion.

How SPACs Function

SPAC, according to the SEC, stands for special purpose acquisition company and it is a type of “blank check” company. The SPAC basically has no operations but offers securities for cash and places substantially all the offering proceeds into a trust or escrow account for future use in the acquisition of one or more private operating companies. Following its IPO, the SPAC will identify acquisition candidates and attempt to complete one or more business combination transactions after which the company will continue the operations of the acquired company as a public company.

Unlike the traditional IPO process, where a private operating company sells its securities in a manner in which the company and its offered securities are valued through market-based price discovery, the management team (and/or the directors, officers and affiliates) of the SPAC is solely responsible for deciding how to value the private operating company and how much the SPAC will pay for it. Similar to a private equity fund, SPACs generally commit to complete an acquisition within a specified timeframe.

The SPAC Boom

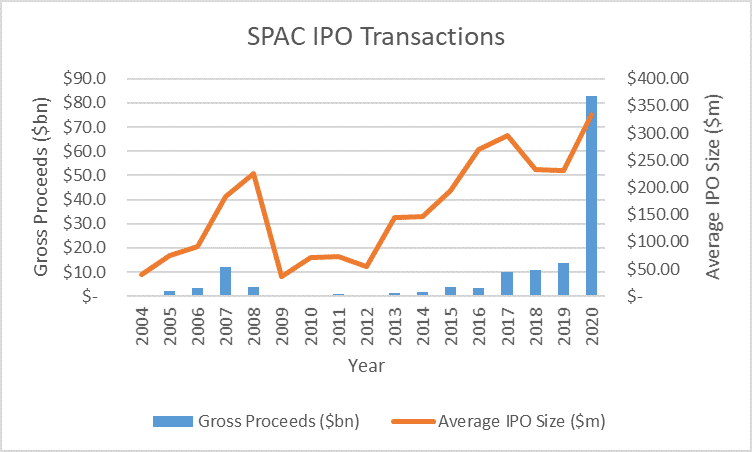

As illustrated below, SPAC IPOs exploded in 2020 with $83 billion raised by 248 SPACs (that’s $14 billion more than what was raised in the previous 16 years combined).

Source: SPACInsider.com & PKF Investment Banking

Through January 25, 2021, an additional 67 SPAC IPOs raised approximately $19.2 billion and there were 71 active filings for SPAC IPOs, indicating that capital raised in 2021 is on pace to far exceed that raised in 2020.

The Road to Being Acquired or Merged into a SPAC

While the availability of capital remains at record levels, the supply of high quality acquisition targets continues to be limited, which is why we foresee a “seller’s market” for companies that have shown resilience or that have flourished during the pandemic. However, merging into or being acquired by a SPAC is not the same as being acquired by another privately-held business or even by a private equity firm.

For private companies, this will mean providing financial statements and other content disclosures that comply with the SEC’s Regulation S-X Rule 3-05 and the US GAAP requirements of a public company, often on an accelerated timeline. Although the SEC issued new rules effective January 1, 2021 to simplify the requirements of Regulation S-X, many business owners and financial departments will still find the financial reporting and disclosure requirements quite onerous.

When it comes to the preparation and inclusion of financial information in a proxy or registration statement related to a merger with a SPAC, the following presents just a few items that may potentially be required:

- Audited financial statements of the acquisition Target for one or more years;

- Audits must be conducted in accordance with PCAOB standards, which may require additional work if previously audited in accordance with AICPA standards;

- Retrospective revision of financial statements if private company accounting alternatives were utilized (e.g., amortization of goodwill);

- Audited financial statements for any significant acquisitions by the Target entity during the prior one or two years;

- Adoption of new accounting standards at the same time as public companies;

- Complete “carve-out” financial statements of the acquired business if the Target is a division of another business;

- Pro forma financial information, including transaction accounting adjustments (i.e., purchase price allocation and fair value of identified intangible assets).

Back to the Future

Business succession can be a complex journey with many twists and turns which is why having a well thought out exit plan is essential. An effective plan should include an evaluation of potential exit strategies as there are different exit channels and each channel rewards different value drivers. In a competitive M&A environment, speed to close and depth of financial reporting are often important factors, and this will be particularly true with SPACs.

Based on the recent boom in fundraising, SPACs represent another possible exit channel in a crowded M&A market that could help sustain high valuation multiples for business owners seeking a liquidity event. Any sales process can feel overwhelming to a closely-held business. However, as briefly illustrated above, merging with a SPAC requires an even higher degree of coordination between buyers and sellers and a prudent business owner should give serious thought to how prepared their business is to be acquired by a SPAC, especially if the SPAC offers the highest purchase price.

So, before a SPAC comes knocking, do your homework and assess whether you can confidently answer the bell.

Contact Us

For further guidance and assistance, please contact your PKF O’Connor Davies client service representative, or:

Jonathan Moore, CPA, CM&AA

Partner

Practice Leader, Transaction Advisory

jmoore@pkfod.com | 201.712.9800