By Ralf Ruedenburg, CPA, Partner

The Internal Revenue Service (IRS) requires U.S. persons to provide information about foreign corporations using Form 5471, Information Return of U.S. Persons with Respect to Certain Foreign Corporations. In many scenarios, it is unquestionable that the requirements to file the Form are met. For instance, individuals, corporations, or partnerships that wholly own a foreign corporation directly clearly must file Form 5471. In other situations, the filing requirement is not that obvious. U.S. persons can be required to file Form 5471 even if they do not own a foreign corporation directly or indirectly since the repeal of an Internal Revenue Code (Code) section that prevented the so-called “downward attribution.” The IRS has provided relief from this outcome, but not in all cases.

The Issue

The Tax Cuts and Jobs Act (TCJA) of 2017 significantly expanded the constructive ownership rules for determining whether a foreign corporation is a controlled foreign corporation (CFC) and, thus, if Form 5471 needs to be filed or not. Overnight, thousands of foreign corporations became controlled foreign corporations (CFCs) according to the plain language of the Code. Downward attribution is the concept that stock ownership by a corporation’s owner is attributed as owned, for instance, by another corporation.

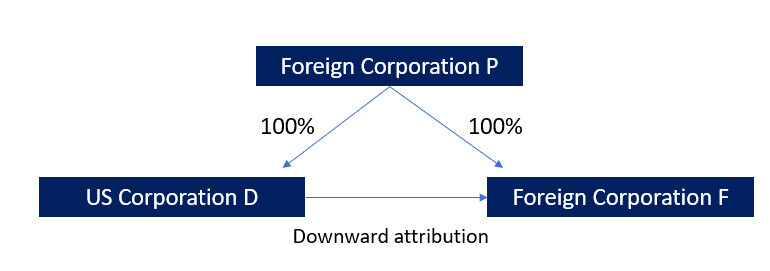

The following non-complex scenario is an example where the downward attribution is applicable. Foreign corporation P wholly owns two subsidiary corporations, foreign corporation F and U.S. corporation D. Attribution rules require P’s shares of F to be attributed downward to D, making D a U.S. shareholder and F a Controlled Foreign Corporation for D. With the repeal of the Code section that prevented this downward attribution, D is required to file Form 5471 with regard to F.

Although the repeal of the prohibition against downward attribution happened with the TCJA over five years ago, the application and consequences are sometimes overlooked, especially in multinational groups with a huge number of foreign subsidiaries and complex ownership structures.

The Solution

As the IRS realized that the initial goal of the repeal to combat certain narrow decontrolling CFC transactions in connection with corporate inversions resulted in filing requirements for a huge number of U.S. taxpayers, it has tried to provide relief from certain Form 5471 filing obligations. It must be noted that the Code itself has not been changed to provide relief as of now. Relief is only provided in IRS notices and revenue procedures that are implemented in the instructions for Form 5471.

First, the IRS created sub-categories of Form 5471 for constructive ownership, which provide a more limited scope of information than a typical Form 5471 filing. Further, the IRS provided two exceptions from filing Form 5471 in certain scenarios. The Form 5471 filing requirement for a Category 1 or 5 filer does not exist if the following requirements are met:

- The Category 5 filer does not own a direct or indirect interest in a foreign corporation and

- The Category 5 filer is only required to file Form 5471 because of constructive ownership from a nonresident alien. This includes the constructive ownership based on the downward attribution rules, but would seem to apply only to ownership by foreign individuals.

The instructions also provide a second exception. A Category 1 or 5 filer does not have to file Form 5471 if all the following conditions are met:

- The filer is a U.S. shareholder that only owns stock, within the meaning of the constructive ownership rules in §958(b) in the foreign corporation;

- The filer is not related, using principles of §954(d)(3), to the foreign corporation; and

- The foreign corporation is a foreign-controlled corporation.

However, this exception would appear to be of limited value as in the scenario above, the U.S. corporation D is related to corporation F because it has greater than 50% common ownership.

The current instructions seem to provide a more narrow exception than the original IRS guidance in the area (and prior instructions) which provides an exception if the foreign corporation was a CFC solely because one or more U.S. persons was considered to own the stock of the foreign corporation owned by a foreign person.

PKF O’Connor Davies Guidance

U.S. persons should review whether a Form 5471 filing requirement exists, considering the potential application of the attribution rules, particularly in light of the changes to the IRS instructions. The IRS provides relief from the filing requirements but only when certain requirements are met. U.S. persons need to make certain that supporting documentation for the exception can be provided upon request of the IRS during an examination.

Contact Us

As always, if you need any assistance, please reach out to your PKF O’Connor Davies client service team or:

Ralf Ruedenburg, CPA

Partner

rruedenburg@pkfod.com.