M&A Outlook for 2021: An Active Seller’s Market

A Wealth of Opportunity for Owners Considering Selling Their Businesses

By Robert Murphy, Senior Managing Director

The year ahead holds the promise of a dynamic seller’s market likely to drive a healthy mergers and acquisitions (M&A) market. Companies with strong operating performance should be highly competitive. With a flexible approach and proper planning, even those that suffered setbacks can garner buyers with attractive offers in an arena flush with capital.

The promising M&A market in the year ahead reflects the interplay of several key factors: low interest rates, abundant capital in search of targets, larger companies seeking to grow and diversify through acquisitions, aging baby-boomer business owners ready to exit and optimism for an economic landscape improving with the rollout of COVID-19 vaccines.

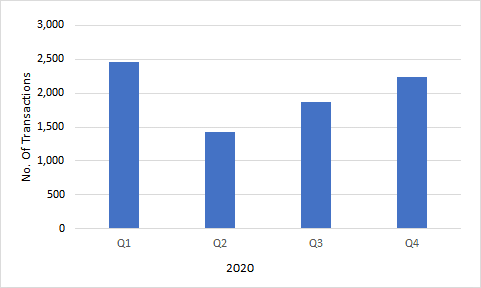

Despite the pandemic-induced economic crisis that raged throughout the year, the Dow and S&P 500 finished 2020 at record levels, up 7.25% and 16% respectively. Public market activity was also strong in 2020, with 480 Initial Public Offerings (IPOs) in the U.S. market, including 248 Special Purpose Acquisition Company (SPAC) transactions, an increase over 2019’s 233 IPOs, with 60 SPACs. After taking a significant hit in the second quarter of 2020, M&A activity, along with the stock markets, rebounded sharply in the third and fourth quarters – a trend expected to persist well into 2021.

Source: Capital IQ and PKF Investment Banking Research

Private company transactions in 2021 are expected to continue the strong comeback pace set in Q3 and Q4, 2020.

Favorable Interest Rates: Interest rates remain at historically low levels with the 10-year Treasury rate at 1.10% and the prime rate at 3.25%, as of January 22, 2021.

Demand Exceeding Supply: The setbacks many companies endured in 2020 have limited both the quantity and quality of attractive acquisition candidates, contributing to a heightened level of buyer demand that exceeds supply by a large margin. According to the Wall Street Journal, there is abundant pent-up demand for deals, coupled with an estimated $1.5 trillion in private equity “dry-powder” that must be deployed. This excludes the capital held by non-financial buyers that are looking for acquisitions and investment opportunities.

An Industry-Specific Approach: The 2021 market could be considered a “tale of two companies.” One company with operating results not impacted by COVID-19 sells at the same valuation multiple or higher as it would have pre-COVID-19 with the same or similar consideration structure. Yet, another company with financial performance negatively impacted by COVID-19 sells at a reduced valuation multiple with a 3-year earn-out component. The first example is more likely to represent companies in the e-learning, cybersecurity and home entertainment sectors while the second group includes the entertainment, hospitality and retail industries that suffered substantially. Therefore, in cases where COVID-19 has negatively impacted a company’s operating performance, buyer creativity and seller flexibility will be key to completing a transaction.

Trends to Watch: Sellers should be aware of, and keenly attuned to, essential developments affecting business valuations and transaction terms in the year ahead. Understanding how these can influence a sale are central to preparing for, and orchestrating, a successful deal. Examples include the following:

- Stable or increasing valuation multiples in sectors with minimal or no negative impacts from COVID-19.

- Lower valuation multiples in certain sectors due to decreased debt leverage, lower financial performance and lack of visibility with future earnings.

- Increase in use of seller notes due to decrease in debt leverage and desire for more liquidity at transaction closing.

- Increase in use of contingent earn-outs due to lack of visibility with future earnings or to bridge valuation gaps between seller and buyer.

- Increased use of subordinated debt in the capital structure due to decreases in bank leverage.

- Elongated due diligence period due to buyer/lender’s desire to see more current operating results, additional financial modelling scenarios and work from home/travel concerns.

- Heightened attention on continuation of profitability and growth.

- Adjustments for non-recurring COVID-19 impacts, both positive and negative.

In today’s M&A market, more than ever, valuation multiples, consideration structure, deal terms and closing time are specific to the company and the industry. We encourage business owners considering a sale in this promising market to contact us for a no-obligation, confidential conversation.

Contact Us

Robert Murphy

Senior Managing Director

rmurphy@pkfod.com

561.337.5324 | 201.788.6844