By Alberto Sinesi – Director, Consumer and Food & Beverage

The food and beverage sector remained active during the second quarter of 2024 with mergers and acquisitions (M&A) transactions completed across various segments, including snacks, bakery, meats/protein and ingredients, among others. Overall deal activity in this space has been supported by acquisitive strategics and private equity-backed acquirers looking for add-on acquisitions. We also observed a growing number of financial sponsors enter the food & beverage sector, capitalizing on their existing investment experience with portfolio companies in industrial manufacturing, distribution and consumer products.

Overall, there is an abundance of available capital in the U.S. to spur M&A activity, with corporate cash on hand estimated at $4T (Source: Bloomberg) and $1T of accumulated private equity dry powder (Source: 2024 US Private Equity Outlook Midyear Update), as well as an improved debt financing market. Looking forward, as interest rates hold firm and with the possibility of a rate cut in late 2024, the stage is set for continued momentum during the second half of the year and heading into 2025.

Key Food & Beverage Industry Highlights: Segments Witnessing Growth

- Global flavors and fusion cuisine – Consumers are eager to explore unique and diverse flavors from across the globe. The popularity of fusion cuisine is further amplified by social media and influencers.

- Functional/better-for-you beverages – Functional beverages are witnessing substantial growth, especially for consumers who desire a sober lifestyle. Mushroom beverages are increasingly popular.

- Proteins – Shoppers are increasing protein intake across multiple eating occasions and food types (e.g., ready-to-drink protein beverages, protein-rich snacks, etc.).

- Nutrient-rich foods – There is growing attention around the positive health effects of consuming nutrient-rich, minimally processed fats such as olive oil, avocado oil, etc.

- Premium and fresh foods – Rising demand for premium and fresh food items is motivating many grocery retailers to reassess historically stable categories and find new brands or launch private brands of their own.

- Frozen foods – The frozen food sector continues to witness robust growth – while the pandemic has paved the way for this trend, manufacturers in this space have continued to invest in technological advancements (e.g., freeze drying, air drying and vacuum techniques) and launched a varied range of frozen products.

- Sustainability-centric brands – Consumers are sensitive to enhanced biodegradable packaging, recycled bottles and regeneratively raised meats.

Observations on M&A Activity and Related Drivers

- On average, food & beverage sector valuation multiples have remained resilient, outpacing M&A multiples in the broader consumer industry.

- Acquirers in the food & beverage sector have progressively emphasized target companies’ sales volume growth item pricing as food price increases are anticipated to decelerate throughout 2024.

- Large strategic players and emerging brands are investing in self-manufacturing capabilities via M&A.

- Moreover, large strategics are shedding off non-core assets in their portfolios and cautiously expanding their presence within attractive, high-velocity categories (e.g., pet, indulgent snacking, BFY sauces) while adding brands they like.

- The private label segment is gaining a foothold across multiple food & beverage categories in the current economic environment as inflationary pressures remain.

- The branded subsector has continued to generate considerable levels of M&A activity as strategics have been on the lookout for strong brands and product categories.

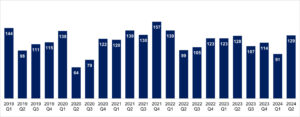

Food & Beverage M&A Transaction Volume (Deal Count as of June 30, 2024)

Source: PitchBook, PKF Investment Banking

Note: Includes food & beverage sector transactions where the target company was based in the U.S.; includes minority equity deals.

M&A Landscape – Selected Strategic Inorganic Growth Perspectives

Over the past 12 to 18 months, strategic acquirers have dominated the food & beverage M&A market. Such players have been pursuing accretive acquisitions as they seek synergies, economies of scale, increased negotiation power with suppliers and additional revenue opportunities – often paying healthy multiples. Selected highlights and related future corporate M&A plans are listed below:

- Grupo Bimbo (MEX: BIMBOA) – “Following a record 2023, we are kicking off 2024, a year of investing and transforming our business, with a first quarter where we saw the benefits of geographic, category and channel diversification which allowed us to invest in a business unit for future growth, which is the case of North America. We completed four bolt-on strategic acquisitions globally […]” – Daniel Servitje, Chairman and CEO | Grupo Bimbo; U.S. brands include Entenmann’s, Sara Lee, Thomas, etc.

- Danone (PAR: BN) – “As part of our ‘Renew Danone’ strategy, we committed to a portfolio review and asset rotation for businesses that fell outside our priority growth areas of focus to drive value creation. Today marks an important milestone in delivering this commitment while giving the Horizon Organic and Wallaby businesses the opportunity to thrive under new leadership. This sale, once completed, will allow us to concentrate further on our current portfolio of strong, health-focused brands and reinvest in our growth priorities” – Antoine de Saint-Affrique, CEO | Danone. In January 2024, Danone agreed to sell its U.S. premium organic dairy business to investment firm Platinum Equity.

- General Mills (NYS: GIS) – “We don’t play the short-term game when it comes to M&A. We go get brands we like. We hold them for a long time. We grow them. We’ve been doing that for 165 years, and we’ll continue to do that […]” – Jeff Harmening, CEO | General Mills

Selected Recent Food & Beverage M&A Transactions

Ann. Date | Target | Acquirer | Target Description | Deal Value ($m) | EV / | EV / |

Jun-24 | Tropical Smoothie Cafe | Blackstone | Fresh food/smoothie chain | $2,000 | — | — |

Jun-24 | St. Armands (Hyde Park Capital) | Engleman’s Baking | Bakery products | — | — | — |

Jun-24 | Table Talk Pies | Rise Baking Co. | Full-line pie producer | — | — | — |

Jun-24 | Hero Snacks | West. Smokehouse (AUA Private Equity) | Natural meat jerky | — | — | — |

Jun-24 | Joe & Ross | GlacierPoint Enterp. (Mill Point Capital) | Distributor of frozen and refrigerated food products | — | — | — |

Jun-24 | CP Kelco | Tate & Lyle | Pectin, gums / ingredients | $1,800 | — | — |

Jun-24 | Inovata Foods | Swander Pace | Private label frozen entrees | — | — | — |

May-24 | CRS OneSource | Twin Ridge Capital | Distributor of food products for restaurants/schools | — | — | — |

May-24 | Kenny’s Great Pies | Dessert Holdings | Premium, clean label pies | — | — | — |

May-24 | The Santa Barbara Smokehouse | PANOS Brands | Smoked salmon producer | — | — | — |

May-24 | Sea Smoke | Constellation Brands | Pinot noir and chardonnay | — | — | — |

May-24 | Chalet Desserts | Encore Consumer Capital | Frozen bakery desserts | — | — | — |

May-24 | Funct. Formularies (Swander Pace) | Danone | Feeding tube formulas | — | — | — |

May-24 | Lucky Spoon Bakery | Rubicon Bakers | Gluten-free bakery products | — | — | — |

May-24 | Kunzler | Clemens Food | Pork meat products | — | — | — |

May-24 | Klement’s Sausage | Amylu Foods | Small-batch sausages | — | — | — |

May-24 | Bar Bakers | Trufood Manufact. | Nutritional snacks | — | — | — |

May-24 | Sonoma Creamery | Our Home | Cheese-based snacks | — | — | — |

May-24 | DYMA Brands | Ventura Foods | Seasonings/dry mixes | — | — | — |

Apr-24 | Burklund Distributors | AMCON | Distributor of food and convenience store products | $20 | — | — |

Apr-24 | Strong Roots | McCain Foods | Plant-based snacks | — | — | — |

Apr-24 | Prime Meats | Shoreline Equity | Processor of various meats | — | — | — |

Apr-24 | Idan Foods | Woodland Foods | Baking mixes/seasonings | — | — | — |

Apr-24 | OWYN | Simply Good Foods | Plant-based protein shakes | $280 | 2.3x | 13.3x |

Apr-24 | Flavor Producers | Glanbia | Natural flavors and extracts | $355 | 4.1x | 18.0x |

Apr-24 | Firehook Bakery | Forward Consumer | Artisan baking company | — | — | — |

Apr-24 | Thinsters | J&J Snacks | Bite-sized cookies | — | — | — |

Source: Pitchbook, FactSet, PKF Investment Banking

Note: Dollars in U.S. millions

Top 10 Trends from the 2024 Summer Fancy Food Show

On June 23–25, the PKF Investment Banking team attended the Specialty Food Association’s Summer Fancy Food Show at the Jacob Javits Convention Center in New York City. More than 29,000 specialty food & beverage industry professionals came together for the event and over 2,400 domestic and international companies across 40+ specialty food & beverage categories exhibited at the show. Here is the list of the top 10 major trends and key takeaways we observed at the conference:

- Diversity and inclusivity – Fun, inviting flavors and products are seen as means to learn more about other cultures and communities and share diverse experiences.

- Stick to the basics – Many food brands have been refocusing on the fundamentals such as taste/flavor, packaging and high-quality ingredients.

- Uncompromised innovation – Steady product innovation is striving to offer positive nutrition alternatives for people and the planet without compromising on flavor and taste.

- Accelerating the upcycled food economy – Upcycled food products (branded and private label) with a higher degree of sustainability-related claims enjoy higher loyalty.

- Convenient, on-the-go and versatile food – “Snackifying” regular meals is boosting demand for more balanced snacks that serve as adequate nutrition in convenient formats.

- Mocktails on the rise – An increasing number of beverage companies are promoting non-alcoholic offerings (e.g., mocktails) and/or functional benefits.

- Fermented specialties – Fermented specialty foods and beverages – from kombucha and yogurt to kimchi – continue to interest shoppers looking for products that provide probiotics and other nutritional attributes.

- Honey is everywhere – Honey and honey products are a major trend right now – from infused teas to honey hot sauce.

- Plant-based ingredients – Rising public awareness of the perceived positive environmental and health impact of plant-based ingredients has and will continue to fuel interest in these products long-term.

- Cooking at home – Unlike 2020, when consumers were forced to cook at home, the more recent version (2022 – 2023) of cooking at home is partly due to mitigate the effects of high food prices and partly because consumers are looking to create restaurant-quality meals and foster exclusive experiences directly from their kitchen.

Contact Us

Alberto Sinesi

Director, Consumer and Food & Beverage

PKF Investment Banking

asinesi@pkfib.com | 203.273.5024

About PKF Investment Banking

PKF O’Connor Davies Capital LLC (DBA PKF Investment Banking) is a subsidiary and investment banking affiliate of PKF O’Connor Davies Advisory LLC. Securities-related transactions are processed through an unaffiliated broker-dealer, Burch & Company, Inc.

Whether a business owner is ready to sell the company or seeking growth through acquisition, our investment banking team is committed and credentialed to help owners achieve their objectives. PKF Investment Banking provides guidance through every step of the process and brings the expertise to enhance certainty to close – while always staying focused on maximizing the value derived from the transaction.

With deep expertise in and a dedicated focus on advising privately held middle-market businesses, the PKF Investment Banking team has completed over 300 M&A and capital raise engagements in North America and abroad during their careers. Our key services include sell-side and buy-side M&A advisory, exit readiness and transaction planning. For more information, visit www.pkfib.com.

PKF Investment Banking provides this report for information purposes only and it does not constitute the provision of financial, legal or tax advice or accounting or professional consulting services of any kind.